Selections from magazines to the accountant. We receive corporate cards for accountants Settlement limit on a corporate card

The texts of the Letters of the Ministry of Finance and the Federal Tax Service mentioned in the article can be found: section “Financial and personnel consultations” of the ConsultantPlus systemA corporate bank card is a good way out if employees need to pay for something themselves. The money in the account belongs to the organization, but the card is issued to a specific employee clause 1.5 of the Regulations, approved. Central Bank of December 24, 2004 No. 266-P (hereinafter - Regulation No. 266-P). We will tell you about the rules for using a corporate card and accounting for operations related to it.

RULE 1. It is necessary to inform the tax and non-budgetary funds about the card account

A separate bank account is opened for a corporate card paragraph 2 of Art. 11 Tax Code of the Russian Federation. This account (both its opening and its closure) must be reported to the IFTS, the FIU, and the FSS at the location of the organization.

The FIU-recommended form for reporting the opening of an account can be found at: PFR website→ Employers → Payment of insurance premiums and submission of reports → Reporting and the procedure for its submission → Recommended sample documentsThis must be done within 7 working days from the date of opening such an account. paragraph 2 of Art. 23, paragraph 6 of Art. 6.1 Tax Code of the Russian Federation; p. 1 h. 3 art. 28, part 6 of Art. 4 of Law No. 212-FZ of July 24, 2009 (hereinafter - Law No. 212-FZ); Resolution of the Presidium of the Supreme Arbitration Court dated 21.09.2010 No. 2942/10. To do this, send:

- to the tax office - a message in the form No. C-09-1 approved Order of the Federal Tax Service of 09.06.2011 No. ММВ-7-6/ [email protected] . When filling out this form, inform about opening a bank account, and not about the emergence of rights to use a corporate electronic means of payment (CESP). After all, KESP and a corporate bank card are not the same thing.

Reports

| 1 - about opening an account 2 - about closing an account 3 - on the emergence of the right to use KESP 4 - on termination of the right to use KESP |

When reporting to the Inspectorate about opening a bank account to use a corporate bank card, in these cells of form No. C-09-1, you must put "1" | 1 - in the bank 2 - in the body of the Federal Treasury (another body that opens and maintains personal accounts) |

- in the FSS - a message according to the form recommended by him FSS letter dated December 28, 2009 No. 02-10/05-13656;

- to the FIU - a message in the recommended form, which can be found on the Fund's website.

By the way, several cards can be issued to one card account - the main and additional e clause 2.1 of Regulation No. 266-P. Moreover, cards for different employees of your organization can be issued to the same account. It is not necessary to report the issue of each of the additional cards to the inspection and funds.

RULE 2. Issuance of a corporate card is not reflected in accounting accounts

The card itself belongs to the bank, so it is not reflected in the accounting. If the bank card is registered and the employee himself will receive it at the bank, then it is not necessary to keep a register of bank corporate cards. Although sometimes an accountant has to fill out a power of attorney for a specific employee to receive a corporate card in a bank (a sample power of attorney, as a rule, is provided by the bank itself).

The bank can inform your organization about which employee the cards were issued to in the register for issuing international corporate cards or in another document (this depends on the document management system adopted by the bank and the conditions specified in your agreement with it).

RULE 3. It is not necessary to transfer money received by an employee through an ATM through the cash desk

Recently, accountants have been complaining that inspectors make remarks to them during inspections: the cash book does not reflect operations for withdrawing money from a bank card by employees. Allegedly, on the day of their withdrawal, this money must be registered as received at the cash desk and immediately - as issued against a report. If such money did not pass through the cash desk, then the organization is fined for not posting cash to the cash desk and Art. 15.1 Administrative Code of the Russian Federation.

Reader's opinion

“When we first opened a bank corporate card, we were afraid that there would be difficulties with the calculation of the cash balance. After all, we close at 18.00, and an employee can withdraw cash through an ATM even late at night. But it turned out that this money at the checkout does not need to be spent at all.

Zuhra,

Ufa

However, it is clear that the money physically “did not get into the cash register”. So the accounting department can neither capitalize them, nor issue them under the report. Therefore, such transactions should not be reflected in the cash book. And the courts support just such a position, refusing to tax authorities to collect fines from organizations Decree 7 of the AAC of December 20, 2012 No. A03-6142 / 2012; 3 ААС dated 30.01.2013 No. А33-15574/2012.

It also follows from this that money withdrawn from the card in cash does not need to be taken into account when calculating the cash balance at the end of the day.

RULE 4. The employee must report on "card" money

The employee in whose name the card is issued can use it to pay for purchases or withdraw cash through an ATM clause 2.5 of Regulation No. 266-P. The money that is on the corporate bank card account is the money that the employee has not yet received and which he has not yet used in any way. The employee will need to report for them only when he either withdraws cash from the card or pays for something with the card.

Money received from an ATM essentially akin to money given to an employee on account. After all, first of all, it is the money of the organization. Of course, after each purchase, the employee should not immediately run to the accounting department and write a report. It is enough to do this once every few days - the order must be approved by the head of the organization. The amount that an employee can spend is limited by the balance of money on a corporate card (unless, of course, a credit limit is set on the card and the possibility of overdraft is not provided). By contacting the bank, the organization can set additional restrictions for each of the cards.

Corporate bank cards, as it is clear from the brochures, are the best means of making settlements with partners, paying expenses, including travel and hospitality expenses. It is comfortable and prestigious. Is it really?

So, let's look at the question of what a corporate bank card is and what pros or cons it provides to company employees.

First of all, we recall that a bank plastic card is a nominal means of payment intended for paying for goods or services, as well as for receiving cash from ATMs and banks. A corporate bank plastic card is no different from others in this respect. It also opens to a specific individual. But its peculiarity is that this person must be an employee of the organization that has concluded an agreement to issue such a card. Another difference between corporate cards and others is that an employee gets full access to one of the accounts of a legal entity, that is, manages the organization's funds.

To apply for a corporate card, you must:

1. Conclude an agreement with the bank on the issuance and maintenance of corporate cards.

2. Attach to the contract:

- a list of company employees who will use the cards;

- employee applications for card issuance;

- powers of attorney from the enterprise for employees - cardholders.

3. Submit to the bank the documents required to open a ruble (currency) card settlement account.

There are plenty to choose from

Legal entities can open two main types of cards for their employees:

- payment card. It is intended for transactions by its holder within the amount of funds established by the bank, the settlements for which are carried out at the expense of the company's money in its bank account;

- credit card. Settlements on it are carried out at the expense of funds provided by the bank in the established limit in accordance with the terms of the loan agreement.

With the help of a corporate card, employees can receive cash, pay expenses related to business activities, including travel and hospitality expenses in the Russian Federation, receive cash in foreign currency outside Russia, and pay travel expenses. and entertainment expenses in foreign currency outside the territory of our country. By the way, most often firms use bank cards to pay for hospitality and travel expenses.

Accounting for bank accounts...

The basis for compiling settlement and other documents to reflect the amounts of transactions performed using payment cards in accounting is the register of payments issued by the bank, or an electronic journal. Write-off or crediting of funds for card transactions is usually carried out no later than the business day following the day the bank receives the register of payments, or an electronic journal from a single settlement center. Subsequently, these documents can be obtained by the firm.

When opening or closing an account with a bank servicing corporate cards, it is necessary to notify the inspection within seven working days from the date of its opening or closing.

The transfer of funds to card accounts should be reflected in the accounting as follows:

Debit 55 Credit 51 (52)

– funds were transferred to the bank card account from the settlement (currency) account.

The amount of remuneration that the bank charges for servicing a special card account is an operating expense in accounting and is accounted for as follows:

Debit 91 Credit 55

- paid bank services.

However, the most difficult thing is to organize analytical accounting for the sub-account "Special card account". After all, accounting for this subaccount should be organized in the context of specific card accounts opened in a particular bank. In addition, analytical accounting is significantly affected by the conditions for issuing and using bank cards offered by a financial institution. So, for example, when concluding an agreement, a bank may put forward a condition on the presence of a minimum balance on the organization's account (an insurance deposit that can be used for settlements in exceptional cases to cover the excess of the payment limit). In this case, it is advisable to use sub-accounts of the second order, for example, "Special card account - minimum balance" and "Special card account - payment limit".

If several cards are opened for a special card account, then any holder can carry out transactions using them within the general payment limit. In this case, analytical accounting of cardholders is not required until the moment the funds are issued to the accountable person.

When each payment card corresponds to a separate account, then when transferring funds to a special card account, a special statement is transmitted to the bank containing the data of holders and card numbers, as well as the amounts to be credited to each bank card. In this case, analytical accounting is kept in the context of holders of issued cards. When opening a bank card in foreign currency, it must be borne in mind that foreign currency held on a special card account must be revalued on the date of the transaction and on the date of preparation of financial statements (PBU 3/2000 “Accounting for assets and liabilities whose value is expressed in foreign currency ").

Arising exchange rate differences are taken into account for the purposes of accounting and tax accounting, and in both types of accounting, the amount of exchange differences is considered non-operating income (expenses). In accounting, exchange rate differences are included in financial results and are reflected as follows:

Debit 55 Credit 91

- reflects the amount of positive exchange rate difference;

Debit 91 Credit 55

- reflected the amount of the negative exchange rate difference.

If an organization has entered into an agreement for the issuance of corporate credit cards, then the following operations will be made in accounting:

Debit 55 Credit 66

– the loan amount was credited to a special card account on the date of disbursement of funds;

Debit 91- 2 Credit 66

- interest on the loan has been accrued (posting is done periodically, within the time limits established by the agreement for paying interest. - Author's note);

Debit 66 Credit 51

- the interest on the loan is listed;

Debit 10 Credit 55

- credited goods and materials (if the funds from the corporate card were spent on the purchase of goods and materials. - Author's note).

...and with company employees

A corporate card is a personalized means of payment intended for employees to pay for goods or services, as well as to receive money at ATMs and banks.

The bank writes off money from the card current account of the enterprise as the settlements on the operations of the holders are carried out. It is believed that the funds debited from the account were issued under the report to the employee of the organization. In stores, hotels and other places of settlement, an employee of the organization receives documents confirming the expenses made on the card. Such documents are hotel bills, travel tickets, receipts, checks, invoices, etc. They must be accompanied by original slips, receipts from electronic terminals and ATMs. An employee of the organization submits all these documents to the accounting department of the enterprise along with an advance report. If he did not do this, and the bank statement indicates that cash was withdrawn from the card account, the accountant of the organization reflects the debt of the employee of the organization as follows:

Debit 73 Credit 55

- reflects the write-off of cash from a special card account, not confirmed by primary documents.

Upon receipt of the advance report, the expenses incurred (related to the production activities of the organization) are reflected in the general manner. If the expenses incurred by the employee of the organization are not related to production activities, then the latter is obliged to reimburse them.

Reimbursement by the employee of these amounts can be made in two ways: either the employee of the organization contributes cash to the cash desk of the organization, or the organization withholds the amount of damage from the employee's salary. The accountant will issue the following entries in this case:

Debit 50 Credit 73

– contribution by the employee of cash to reimburse expenses;

Debit 70 Credit 73

- withholding from the employee's salary the amount of money spent on a corporate card for personal purposes.

Corporate cards and taxes

When opening or closing an account with a bank for servicing corporate cards, it is necessary to notify the inspection within seven working days from the date of its opening or closing (Article 23, 6.1 of the Tax Code of the Russian Federation). For violation of this period, a fine of 5,000 rubles is provided for under Article 118 of the Tax Code of the Russian Federation.

The Federal Tax Service has always adhered to this position. And recently the Presidium of the Supreme Arbitration Court of the Russian Federation agreed with it. In their decision of September 21, 2010 No. 2942/10, the judges confirmed that if a company did not send a notice to the tax office about opening a business account in a timely manner, then the penalty for such a violation was lawful.

If a company has issued corporate credit cards for its employees, it is necessary not to forget about the tax accounting for interest on the use of these credit funds. In tax accounting, the maximum amount of interest recognized as an expense that reduces the taxable base for income tax is taken in the following amount (Article 269 of the Tax Code of the Russian Federation):

- equal to the refinancing rate of the Central Bank of the Russian Federation, increased by 1.1 times - when registering a debt obligation in rubles;

- equal to 15 percent - for debt obligations in foreign currency.

Currency corporate cards entail additional transactions for taxation purposes - differences resulting from the deviation of the selling (purchasing) rate of foreign currency by the issuing bank from the official rate of the Bank of Russia are taken into account when taxing profits. They are reflected on the date of sale (purchase) of the currency (clause 6, clause 7, article 272 of the Tax Code of the Russian Federation, clause 7, clause 4, article 271 of the Tax Code of the Russian Federation) and are accounted for as non-operating expenses (clause 6, clause 1, article 265 Tax Code of the Russian Federation) or income (Clause 2, Article 250 of the Tax Code of the Russian Federation). These exchange differences can reduce the tax base for income tax only if the employee, having bought the currency, spends it for official purposes.

Irina Shitik

Corporate cards: accounting, settlements and documents. Accounting entries on a corporate card. Show settlements on a corporate card on account 55 Special accounts in banks sub-account Corporate cards.

Question: The organization issued a corporate card to the general director (nominal) for travel and other expenses, when transferring funds to this card, does the accountant have the right to make posting D 71 k 51 if no one except the director has access to the card.

Answer: Accounting entries will depend on the type of card (debit or credit) and its link to the account:

Debit card:

Dt 71 Kt 55 - withdrew money or paid with a card - a corporate card is linked to a card account;

Dt 71 Kt 51 - withdrew money or paid with a card - the card is linked to the organization's current account;

Dt 71 Kt 57 - withdrew money or paid with a card - the organization does not have access to statements daily, then upon receipt of an extract: Dt 57 Kt 51 (55).

If a credit card:

Dt 55 Kt 66 - loan money received;

Dt 71 Kt 55 - cash was withdrawn from the card, or payment was made by card.

Corporate cards: accounting, settlements and documents

Show settlements on a corporate card on account 55 "Special accounts in banks" subaccount "Corporate cards". Is plastic tied to a settlement, and not to a separate card account? Then use count 51.

Let's say an employee withdrew the amount from a corporate card. Show it by wiring:

DEBIT 71 CREDIT 55 sub-account "Corporate card No. ..."

- issued money under the report from the card account.

And if the card is linked to the current account, then the entry on the debit of account 71 and the credit of account 51 is the subaccount "Corporate card No. ...".

The money that an employee withdraws from a bank card does not need to come to the cashier. Because they don't go through it. Immediately attribute the amounts to the debit of account 71.

If you don’t have daily access to cash flow data, you may find out about withdrawals faster from employees than from the bank. In this case, proceed as follows. When the employee brings the advance report with the receipt, make the entries:

DEBIT 71 CREDIT 57

- money was withdrawn from the account and issued under the report;

DEBIT 20 (26, 44) CREDIT 71

- expenses are reflected on the basis of the advance report.

And when you receive bank statements, then write off the money from the account and take into account the bank commission:

DEBIT 57 CREDIT 55 (51)

- deducted money from the account;

DEBIT 91 sub-account "Other expenses" CREDIT 55 (51)

- The bank's commission is included in the expenses.

If the card is a debit card, use the transactions we discussed above. When using a credit card, keep records on account 66. Let's look at an example.

Let's say an employee paid expenses in the amount of 15 thousand rubles with a corporate card. At the end of the month, the company repaid its debt to the bank and transferred interest in the amount of 750 rubles. Wiring:

DEBIT 55 CREDIT 66

- 15,000 rubles. - received credit money;

DEBIT 71 CREDIT 55

- 15,000 rubles. - funds were withdrawn from the card to pay for household expenses;

DEBIT 26 CREDIT 71

- 15,000 rubles. - expenses are reflected based on the advance report of the employee;

DEBIT 91 sub-account "Other expenses" CREDIT 66

- 750 rubles. - interest for the use of borrowed funds is taken into account in expenses;

Learning to work with corporate cards (1C: Accounting 8.3, edition 3.0)

2018-02-06T11:33:48+00:00In this lesson, we will consider the reflection in 1C: Accounting 8.3 (edition 3.0) of operations with corporate cards.

Corporate is called a bank card linked to the card account of the organization.

Typically, an organization will special card account in the bank and binds to this account the required number of bank cards, which are called corporate.

The organization transfers funds to this card account from its main current account, and employees organizations that have been issued corporate cards, withdraw money from these cards to themselves under the report.

Then the employees report back on spending funds withdrawn from corporate cards with the help of advance reports.

The advantages of corporate cards are obvious:

- reduced costs and time for the issuance of funds under the report

- reduces the risk of losing cash

- it becomes possible to withdraw funds from the card in the desired currency (an indispensable thing when traveling abroad)

- there is control over the spending of funds online (for example, using a mobile application)

- it becomes possible to set limits both for the card account in general and for corporate cards in particular

- opportunity to shop online

Requirements for working with corporate cards:

- funds withdrawn from cards cannot be used for settlements with an employee for remuneration and in general for any social payments

- an agreement is concluded with the bank on the issuance and maintenance of corporate cards, to which is attached a list of employees who will use these cards

I remind you that this is a lesson and you can safely repeat my actions in your database (preferably a copy or a training one), the main thing is that the database version is 1C: Accounting 8.3, edition 3.0.

To work with a card account in the accounting department, account 55 "Special accounts in banks" is used.

Now let's look at the same operations in the "troika" (1C: Accounting 8.3, edition 3.0).

The organization replenishes the card account to which corporate cards of employees are linked

The transfer of funds from the main settlement account of the organization to the card account is issued by the usual debit from the current account.

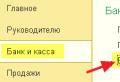

We go to the section "Bank and cash desk" item "Bank statements":

Create a document "Write-off from the current account":

We indicate the type of operation "Transfer to another account of the organization", our card account and accounting account 55.04.

We pass the document:

Employees withdraw money from corporate cards linked to the organization's card account

Withdrawal of money by an employee through a corporate card is displayed by the same debit document from the current account.

Specify the type of operation "Transfer to an accountable person"; as an account we indicate 55.04 and our card account; the cardholder acts as a recipient (accountable person):

We pass the document:

The bank charges a fee for cash withdrawals on a corporate card

When an employee withdraws cash using a corporate card, the bank will withhold a commission. This commission is also documented by a debit document from the current account:

We pass the document:

The employee reports for the spent money withdrawn from the corporate card

And, finally, the employee who withdrew the money under the report is obliged to report on it - to attach supporting documents.

In accounting, this operation is reflected in the document "Advance report".

We go to the section "Bank and cash desk" item "Advance reports":

Let's create a new document:

Let's run it:

This is how easy and simple it is to work with corporate cards in 1C: Accounting 8.3, edition 3.0.

We are great, that's all

By the way, new lessons...

Additions from readers

Accountant Olga Klimova shared valuable additions to the article - I am happy to publish them for all readers.

In very small organizations, a corporate name card can be opened directly to the main current account. Sberbank, for example, actively practices this for micro-enterprises. And then accounting is kept without using account 55 and "Debiting from the current account." The employee simply withdraws money through an ATM or pays with a card: Dt 71 Kt 51.

Quote from the article: "... The organization replenishes the card account to which the corporate cards of employees are attached ... We create the document "Debit from the current account" ...".

Accounting for payment for goods, works or services using a corporate card differs from the traditional accounting of accountable amounts.

Accounting in the company is maintained in accordance with the working chart of accounts. It is developed on the basis of a standard Chart of Accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 N 94n. This is stated in paragraphs 8 and 9 of the Regulation on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 N 34n.

Special account for accounting for funds on a corporate card

Accounting records of all operations on this account using corporate cards must be kept on synthetic account 55 "Special accounts in banks".

For more convenient accounting of operations on corporate cards, a first-order sub-account "Special account of a corporate card" is opened for a synthetic account. But the detailing of the accounting object does not stop there.

Special cases - special sub-accounts

Several card accounts. If several card accounts are opened (for each corporate card), then a sub-account is opened for each card account.

One card account, several users. It is possible that several corporate cards have been issued for one card account. They are used by different employees who have the right to make payments within the general payment limit. In this case, it makes sense to open sub-accounts of the second order in the context of employees.

Entries in the accounting policy

The working chart of accounts is an element of the accounting policy (clause 4 PBU 1/2008). It also needs to describe the system of sub-accounts opened for account 55.

The working chart of accounts, as a rule, is attached to the order on the approval of the accounting policy. An example of such an application is shown on p. 94.

Sample. Working plan account

I approve: Appendix N 3

director to order N 23 dated 09.12.2013

Shmit I.L. Schmit "About accounting policy for 2014"

Working chart of accounts for financial and economic activities of Lunny Kamen LLC

|

Name of account, sub-account |

Cost item |

|||

|

1st, 2nd characters |

||||

|

Section V |

Cash |

|||

50 |

||||

|

Cash transactions in rubles |

||||

|

Cash transactions in foreign currency |

||||

|

Cash documents |

||||

51 |

Settlement accounts |

|||

|

Settlement account in JSC "Sberbank of Russia" |

||||

52 |

Currency accounts |

|||

|

Currency accounts in VTB 24 |

||||

55 |

Special bank accounts |

|||

|

Special bank accounts |

||||

|

Special corporate card account |

Household expenses. Travel expenses. Representation expenses |

|||

Crediting funds to a corporate card

When transferring funds from a current account to a special card account in accounting, you need to make the following entry:

The amount in rubles was transferred from the main settlement account of the company to the corporate card account.

The basis for this entry is a payment order and an extract from the card account confirming the transfer of money.

Write-off of funds from a corporate card is identical to their issuance under a report

On the basis of a bank statement containing information about the details of the card, the accountant makes a record of debiting money. In this case, write-off is the issuance of accountable amounts to the cardholder: .

The employee must report

Funds debited from the special account of the company as a result of a transaction using a corporate card are considered to be issued against the report to the employee.

Within the period established by the regulation on the use of corporate cards, the employee must submit an advance report on spending money from the corporate card.

On the basis of the approved advance report, the accountant will write off the debt of the accountable person, capitalize the inventory items acquired by him, and transfer the amounts of paid travel or business expenses to the cost accounts: Debit 10, 20, 26, 44, 60 Credit 71.

Note. Read more about the advance report form and filling it out on p. 84.

Example 1. Moonstone LLC sends engineer R.A. Ozerov on a business trip from 13 to 14 May 2014. The employee was issued a corporate card.

During the business trip, the employee:

Solution. In the accounting of the company, these transactions will be reflected as follows.

Crediting money to the card

When transferring money to a special card account (to a corporate card) on May 12, 2014, the accountant of the company will make an entry:

Debit 55 sub-account "Special corporate card account" Credit 51

50 000 rub. - reflects the amount transferred from the company's current account to the card account.

Withdrawing funds from the card

In accounting, on the basis of an extract from the bank on a special card account, we make entries:

Debit 71 Credit 55 sub-account "Special corporate card account"

15 000 rub. - funds were debited from a special card account under the report of R.A. Ozerov to pay for air tickets;

Debit 71 Credit 55 sub-account "Special corporate card account"

5600 rub. - funds were debited from a special card account under the report of R.A. Ozerov to pay for hotel accommodation;

Debit 71 Credit 55 sub-account "Special corporate card account"

1400 rub. - funds were debited from a special card account under the report of R.A. Ozerov (per diem).

Advance report approved

After the employee confirms the expenses and submits the approved advance report on the corporate card with the documents attached to it to the accounting department, the accountant will make the following entries:

Debit 44 Credit 71

22 000 rub. (15,000 rubles + 5,600 rubles + 1,400 rubles) - the employee's travel expenses (travel, accommodation, daily allowance) are written off as expenses.

After this entry, account 71 will automatically close, and the balance on account 55 of the sub-account "Special corporate card account" will correspond to the amount not used by the employee - 28,000 rubles. (50,000 rubles - 22,000 rubles).

If the employee does not submit an advance report with supporting documents on time, you need to make a posting:

Debit "Shortages and losses from damage to valuables" Credit 71

The amount not returned in a timely manner is included in the composition of shortages and losses from damage to valuables.

When the company establishes the fault of the employee and the amount of damage caused by him, the accountant needs to make the entry:

Debit 73 Credit 94

Reflected the debt of the guilty employee to compensate for the shortage.

After the money is deposited by him in cash at the cash desk, the accountant will make the posting:

Debit 50 Credit 73

The shortage was reimbursed in cash to the cashier.

In which case you need to use account 57 "Transfers on the way"

Bank statements may not arrive every day. In some cases, the accountant may learn about the movement of money on the card earlier from the employee's advance report.

Accountable persons must keep and attach to the advance report not only primary accounting documents, but also receipts from ATMs and terminals for withdrawing or depositing cash.

In a situation where there is no statement yet, and the advance report has already been approved, it is advisable to reflect the movement of money using account 57 "Transfers on the way". That is, based on the advance report, we make the following entries:

Debit 71 Credit 57

The money was issued for the report.

Debit 57 Credit 71

Money has been deposited by an accountable person for crediting to a corporate bank card.

After receiving the statement, account 57 is closed:

Reflected the debiting of funds from the account;

Debit 55 subaccount "Special corporate card account" Credit 57

The receipt of funds to the corporate card account is reflected.

We write off the debt of the accountable person on the basis of the advance report approved by the head.

Depending on the type of expenses, we select the account to be debited, and the corresponding account will always be account 71 "Settlements with accountable persons":

Debit 20 (10, 26, 44, 60) Credit 71

The expenses of the accountable person are written off.

2. On May 12, 2014, the accounting department of CJSC Sweets of the East transferred V.S. Vatrushkina 100,000 rubles.

May 13, 2014 V.S. Vatrushkin purchased goods for the needs of the company at a retail outlet worth 85,000 rubles. (including VAT - 12,966.10 rubles). On the same day he withdrew cash - 1000 rubles. But he didn't need the money. The next morning, the employee entered them back on the card through the ATM terminal.

May 14, 2014 V.S. Vatrushkin submitted an advance report with supporting documents to the accounting department:

invoice, invoice and consignment note for purchased goods;

ATM receipt for cash withdrawal;

ATM receipt for crediting cash to a corporate card.

How to reflect transactions in accounting?

Solution. In the accounting of the company, these transactions for the acquisition of goods will be reflected as follows.

Advance report approved

Debit 41 Credit 71

RUB 72,033.90 (85,000 rubles - 12,966.10 rubles) - the goods were accepted for accounting on the basis of an advance report and a consignment note;

Debit 19 Credit 71

RUB 12,966.10 - reflects the VAT presented by the supplier (invoice);

Debit 71 Credit 57

1000 rub. - cash was withdrawn by the accountable person from the corporate card account;

Debit 57 Credit 71

1000 rub. - Cash deposited by the accountable person on the card.

As a result of these entries, a credit balance was formed

on account 71 in the amount of 85,000 rubles;

Debit 68 Credit 19

RUB 12,966.10 - set for VAT deduction on the purchased goods.

Before receiving a bank statement, the accountant will make the following entries:

Debit 71 Credit 57

85 000 rub. - Accounts receivable of the accountable person is reflected, which at this moment is not confirmed by the bank statement on the company's special card account.

Records after receiving a bank statement

Debit 57 Credit 55 sub-account "Special corporate card account"

85 000 rub. - funds were debited from a special card account to pay for goods;

Debit 57 Credit 55

1000 rub. - withdrawn cash from the corporate card;

Debit 55 Credit 57

1000 rub. - deposited cash on the card.

Account balances

After these entries, account 71 will automatically close, like account 57, and the balance on account 55 of the sub-account "Special corporate card account" will correspond to the amount unused by the employee - 15,000 rubles. (100,000 rubles - 85,000 rubles - 1000 rubles + 1000 rubles).

Personal income tax from amounts transferred to corporate cards

Money transferred to corporate cards are accountable funds. They can be used to pay for goods (works, services) that are produced in the interests of the company (buyer, customer).

Funds on corporate cards belong to the company, not to employees (Resolution of the Federal Antimonopoly Service of the North-Western District of July 18, 2011 N A05-11476 / 2010).

Consequently, the accountable person does not have an economic benefit and the amounts received by him are not recognized as an object of personal income tax (Article 41 and Clause 1, Article 209 of the Tax Code of the Russian Federation). Such amounts are the debt of the accountable person to the company.