Transferring salaries to employee cards: what you need to know. Transferring salaries to a card Transferring salaries to plastic cards

Each employee, in accordance with applicable law, has entitlement to monthly wages. And only he chooses the method by which it is convenient and expedient for him to receive the money he has earned.

Regulations and regulations

The process of transferring salaries directly to the employee's card is regulated by the norms of the current legislation, in particular - Art. 136 of the Labor Code of the Russian Federation. It is through this legislation that the obligation of the employer to pay wages in the place where the employee performs his duties is stipulated.

The process of transferring salaries directly to the employee's card is regulated by the norms of the current legislation, in particular - Art. 136 of the Labor Code of the Russian Federation. It is through this legislation that the obligation of the employer to pay wages in the place where the employee performs his duties is stipulated.

If translated into simple language, then the payment is made in cash at the employer's cash desk. But in connection with the development of modern technologies, in order to simplify this process, the payment of wages is carried out directly to the employee's card.

According to Art. 136 of the Labor Code of the Russian Federation, wages are paid to the employee at the place where he performs his duties, or funds are transferred to the bank credit institution indicated in the employee's application paper on the basis of the conditions that are defined in the framework of the collective or labor agreement.

If desired, the employee has the right to change the bank with which he cooperates, informing the employer about these changes in writing, indicating a new set of details. However, it is necessary to meet the deadlines 5 days before payday.

Switching from cash to non-cash payment

Art. 136 of the Labor Code of the Russian Federation are subject to absolutely all categories of workers and employers. In the classical view, payments are made at the place where the employee performs his duties, however, if desired, the employee can link a card account to his own pay, for this he needs to draw up an application that includes a certain set of necessary information:

- the name of the employer, full name and position, which is assigned to the main employee regulating this process;

- personal information about the applicant;

- the name of the document - this is how the “application for the transfer of RFP to the card” is indicated;

- this is followed by the main text, which notes the following “please transfer my salary and other payments to a bank card using the details (specific data are indicated);

- the application ends with an indication of the date on which it was submitted, as well as a signature.

Almost every financial institution provides for persons who have employees special salary projects. If the employer chooses a cashless payment, he must follow certain algorithm of actions:

- Engage in the preparation of the necessary set of documentation.

- Conclude an agreement on servicing employees' accounts.

- Issue card products to employees.

If the transition is made from a cash payment system to cooperation with financial institutions, local regulations will be subject to additional adjustments and agreements.

Choosing a payroll bank

According to No. 333-FZ, for banks that an employee can choose in order to receive wages, today there are no major restrictions.

According to No. 333-FZ, for banks that an employee can choose in order to receive wages, today there are no major restrictions.

The employer receives the maximum benefit when all employees are served by one banking organization within the framework of a single salary project. If it will be necessary to transfer part of the money to another bank, this will require payment of additional commission.

If suddenly the employee is not satisfied with the main partner bank, and he writes a corresponding application in order to change the credit institution, you should ask which bank is ready to offer the most optimal conditions. It is best to have a separate card and a separate salary account. Also, the choice of plastic should be based on the cost of its maintenance and the possibility of withdrawing cash from ATMs without commission.

Submission of documents

To ensure the transfer of wages to the accounts of other employees, it is necessary to provide a banking organization certain documentation package:

- payment document;

- register to transfer money.

These papers can be compiled in paper or electronic form. The order in which papers are accepted, withdrawn and returned is strictly established by the financial institution.

All this information must be specified in contractual agreements with the financial institution in private. The register must contain the following key information:

- about the employees who will receive the money;

- about banks in which they have open accounts for wages;

- dates and numbers of payment documentation, as well as its total volume;

- amounts separately for each employee.

If the parties come to a general agreement, it will be possible to indicate some additional data.

Accounting postings

The procedure for reflecting the money transferred as a salary depends on where exactly the funds are received:

- to a bank account in which there are open employee cards;

- to personal accounts.

To have a more detailed understanding of the activities carried out, it is necessary to reflect multiple accounting entries:

- Dt 76 Kt 51– transfer of funds as a payment of wages on the basis of an extract.

- Dt 70 Kt 76- Transfer of funds to salary cards.

- Dt 70 Kt 51– direct transfer of wages to the personal account of the employee.

- Dt 44 Kt 70- posting means that the payroll has been accrued to employees working in the sales department.

- Dt 70 Kt 68- withholding personal income tax from the wages of employees.

- Dt 91 Kt 51– payment for banking services related to the production of the relevant cards.

- Dt 60 Kt 51– transfer of advance payment for servicing cards.

- Dt 73 Kt 76– the process of assigning to the employee's account the costs of paying the cost of a bank card.

- Dt 70 Kt 73- withholding from the salary of the employee the cost of the bank card.

If accounting is against

The accounting department is not always happy that an employee decides to receive his money through another bank. And this is not surprising, because this fact will significantly increase their workload. If all employees receive income in one bank, and there are a couple of employees who have chosen another bank, then they will have to draw up another statement. As for the norms of the law, they are always on the side of the employee, so if you want to change the bank, the employer undertakes to provide such an opportunity.

Thus, the employee is assigned the right to choose one or another bank, depending on his personal wishes, and the employer undertakes to provide all conditions for his comfort and convenience.

The procedure for paying wages to a plastic card in 1C is presented in detail in this manual.

Make changes to them. This can be done by approving the amended version of the contract or by drawing up an additional agreement to it. An example of such an additional agreement is provided below.

In addition, the employee must write a statement asking him to transfer wages to his card. The application indicates the account number of the employee.

From November 5, 2014, an employee has the right to demand that the company transfer salary to any card he wants - not only to a debit card, but also to And the company has no right to refuse. Such amendments were made to Article 136 of the Labor Code of the Russian Federation (Article 3 of the Law of November 4, 2014 No. 333-FZ). The only condition is that the employee must write an application at least five working days before the pay day.

For example, the salary in the company is April 10, which means that the application must be in the accounting department no later than April 3. Otherwise, the company has the right to transfer wages in the same order.

When transferring salaries to employees' bank accounts, the organization retains the obligation to pay advances (part 6 of article 136 of the Labor Code of the Russian Federation). Therefore, transfer salaries to employees at least every half a month.

The procedure for transferring salaries to employee cards depends on whether the salary is transferred to the accounts of one or several employees.

Situation: is it possible to transfer the salary of an employee at his request to a third party

Yes, you can. However, remember that this is your right, not an obligation. And the employee must write a statement in which it is necessary to indicate:

- the amount to be transferred to the other side. It can be a percentage of salary or a fixed amount of money;

- the name of the payments from which the accountant will transfer money to third parties (salary, bonus, allowance, etc.);

- the moment of transferring the employee's money to the side. For example, the day of payment of an advance or salary;

- the period during which the specified amount will be received not by the employee himself, but by someone else;

- recipient of money and his bank details;

- the basis for transferring the employee's income to third parties. For example, the return of borrowed money or payment under a contract of sale.

The application must also state that the accountant has the right to deduct the bank commission from his salary. After all, such amounts cannot be included in the costs.

Documentation of payment

To transfer salaries to the accounts of several employees, submit to the bank:

- register for the transfer of funds to employees;

- payment document(s).

Documents can be drawn up both in paper and in electronic form (clause 1.9 of the Regulations approved on June 19, 2012 No. 383-P).

The procedure for acceptance, revocation and return (cancellation) of payment documents (including those with registers) is established by the bank. This information must be specified in the agreement with the bank, as well as in the customer service points (clause 2.2 of the Regulation approved by the Bank of Russia dated June 19, 2012 No. 383-P).

The procedure for submitting and filling out payment documents and the register is established by clauses 1.17, 1.19, 1.24 and Appendix 1 to the Regulation approved by the Bank of Russia dated June 19, 2012 No. 383-P.

Filling out the register. In the register, indicate, in particular, the following information:

- about employees to whom funds are transferred;

- about banks in which employees have salary accounts;

- dates and numbers of payment documents, as well as their total number;

- amounts for each employee.

If necessary, in agreement with the bank, additional information can be specified in the register.

After transferring money to the accounts of employees, the bank returns one copy of the register to the organization with a mark of execution. The register and the corresponding account statement indicate that the salary is credited to the employees' cards. The total amount of the register must match the total amount (of payment orders). Such a conclusion follows from subparagraph 1.19 of the Regulation approved by the Bank of Russia dated June 19, 2012 No. 383-P.

When transferring salaries to the account of one employee, it is not necessary to draw up a register. In this case, it is enough to submit a payment order to the bank.

Payment order. When filling out a payment order for several employees, consider the following features:

- in the "Recipient" field, indicate the name and location of the bank where employees' accounts are opened;

- in the "Amount" field, enter the total amount to be transferred to the employees' accounts;

- in the "Purpose of payment" field, indicate the purpose of the payment and make a link to the date and number of the register (the entry may look, for example, as follows: "Transfer of wages for January 2015 according to the register dated February 5, 2015 No. 2").

Apply these rules regardless of whether the organization transfers salaries through the bank in which it has an account, or through the bank in which employees are served and the organization does not have a current account.

This procedure follows from Appendix 1 to the Regulation approved by the Bank of Russia dated June 19, 2012 No. 383-P.

If the salary is transferred to the account of one employee, then indicate in the payment order:

- in the "Recipient" field - the last name, first name, patronymic of this employee;

- in the "Beneficiary's account" field - the number of the employee's individual account.

Payment accounting

The accounting procedure for non-cash salary payments depends on where it goes:

- to the bank account where the employees' payroll cards are opened;

- to individual accounts of employees opened by them in different banks.

In the first case, reflect the payment of salaries as follows:

DEBIT 76 CREDIT 51

Money was transferred to pay salaries (on the basis of an extract on debiting money from the account of the organization);

DEBIT 70 CREDIT 76

Money was credited to the salary cards of employees (based on the second copy of the register with the bank's mark of execution).

Account 57 "Transfers on the way" is not used in this situation. It is designed to account for money to be credited to the settlement account of the organization, but temporarily not credited to it (Instructions for the Chart of Accounts). At the same time, when transferring salaries, the money is transferred not to the organization’s account, but to the bank’s current account.

In the second case, reflect the payment of wages by posting:

DEBIT 70 CREDIT 51

The salary was transferred to the individual account of the employee (on the basis of an extract on debiting money from the account of the organization).

Example

LLC “Trading firm “Hermes”” transfers the salaries of employees to bank cards.

The contract for the issuance and maintenance of salary cards is concluded with the bank in which the organization has a current account.

The transfer of salaries to bank cards is provided for by the employment contract.

The salary is issued on the 15th (advance amount is 50% of the salary) and on the last day (final payment) of each month.

If the day of issue falls on a weekend, the money is paid to employees the day before, on the last working day before the day of payment.

The total amount of accrued salaries for employees of the sales department in August amounted to 150,000 rubles. Suppose that personal income tax is withheld from this amount in the amount of 19,500 rubles.

Operations for accrual and payment of salaries to employees of the sales department, the accountant of Hermes reflected the following entries.

DEBIT 76 CREDIT 51

75 000 rub. - money was transferred as an advance payment on wages to the employees' bank account (based on a bank statement);

DEBIT 70 CREDIT 76

75 000 rub. - money was credited to the card accounts of employees (based on the register).

DEBIT 44 CREDIT 70

150 000 rub. - payroll for sales staff

DEBIT 70 CREDIT 68 sub-account "Calculations for personal income tax"

19 500 rub. - personal income tax withheld from the salaries of sales department employees.

When transferring wages for August, personal income tax and an advance previously transferred to employees must be deducted from its total amount.

150 000 rub. - 19 500 rubles. - 75,000 rubles. = 55,500 rubles.

Postings were made in the accounting:

DEBIT 76 CREDIT 51

55 500 rub. - money was transferred to pay salaries for August to be credited to the card accounts of employees (based on a bank statement);

DEBIT 70 CREDIT 76

55 500 rub. - the salary for August was credited to the card accounts of employees (based on the register).

Accounting for expenses related to the transfer of salaries to cards

All expenses associated with the use of bank cards to transfer salaries to employees can be divided into three groups:

- expenses related to the issuance of bank cards;

- bank card maintenance costs (usually this is the cost of annual maintenance);

- commission paid to the bank for transferring money to employees' accounts.

The costs associated with the issuance of bank cards are classified as other expenses in accounting (paragraph 7, clause 11 of PBU 10/99). They are shown as follows:

The services of banks for the production of bank cards for employees were paid.

Maintenance of bank cards, as a rule, is paid for a year in advance. In this case, write off the cost of annual maintenance as expenses monthly in equal installments during the term of the contract.

In the accounting of the organization, you need to make the following entries.

When paying for annual maintenance:

DEBIT 60 (76) CREDIT 51

An advance payment for the annual maintenance of bank cards has been transferred.

Monthly throughout the year:

DEBIT 91 sub-account "Other expenses" CREDIT 60 (76)

The cost of bank services for the current month is included in other expenses.

Situation: is it possible to withhold the cost of a bank card from an employee's salary

Yes, you can, but only at the request of the employee himself. The employee has the right to dispose of the accrued salary at his own discretion (clause 2 of article 209 of the Civil Code of the Russian Federation). Therefore, if he writes a statement of consent to reimburse the costs associated with opening and maintaining a bank card, the accounting department has the right to withhold the cost of the card. This cannot be done without the consent of the employee. The list of deductions that an organization can make on its own initiative is limited (part 2 of article 137 of the Labor Code of the Russian Federation).

Withholding the cost of a bank card from the employee's salary, reflect the postings:

DEBIT 73 CREDIT 76

The costs of paying the cost of a bank card are charged at the expense of the employee;

DEBIT 70 CREDIT 73

The cost of a bank card is deducted from the employee's salary.

Taxes and contributions for card payment of salaries

You do not need to withhold personal income tax from the cost of the card and annual service. Ensuring timely payment of wages is not a right, but an obligation of the organization (Article 22 of the Labor Code of the Russian Federation). Therefore, in this case, the employee does not receive income. This means that the cost of issuing and maintaining cards is not included in the tax base for personal income tax. He adheres to a similar position (letter dated January 30, 2006 No. 03-05-01-04 / 13).

The cost of issuing and annual maintenance of salary cards does not need to accrue contributions to the mandatory pension (social, medical) (part 1 of article 7 of the Law of July 24, 2009 No. 212-FZ). Do not accrue on the cost of issuing and maintaining salary cards and contributions to insurance against accidents and occupational diseases. After all, payment for bank services for opening and servicing payroll cards has nothing to do with the work of employees.

Is it possible to take into account the costs of issuing and maintaining salary cards when calculating income tax? The answer to this depends on who the contract with the bank for opening and maintaining an account using bank cards is drawn up for (who is its client).

If an employee of an organization enters into an agreement with a bank for opening and servicing a bank card, then he is a client of the bank and at the same time a card holder. In this case, the organization’s expenses for paying for bank services for issuing and servicing bank cards for employees cannot be taken into account in the calculation (clause 29, article 270 of the Tax Code of the Russian Federation). The same opinion is shared by the regulatory authorities (letters of the Ministry of Finance of Russia dated July 13, 2005 No. 03-03-04 / 1/74, dated March 22, 2005 No. 03-03-01-04 / 1/131, dated April 26, 2005 No. 02-1-08/80).

In this regard, a permanent difference and a permanent tax liability arise in the accounting of the organization:

The amount of a permanent tax liability for the costs of issuing and servicing bank cards is reflected.

Example

Alfa LLC transfers salaries to employees on bank cards. This condition is stipulated by labor contracts. Agreements with the bank for opening and servicing accounts using bank cards are concluded by employees of the organization. In January, the bank received:

6000 rub. - for issuing bank cards;

30 000 rub. - for the annual maintenance of bank cards.

On the day of payment for the bank's services, the accountant of Alfa made the following entries:

DEBIT 91 sub-account "Other expenses" CREDIT 51

6000 rub. - paid bank services for issuing bank cards;

DEBIT 60 sub-account "Calculations on advances issued" CREDIT 51

30 000 rub. - an advance payment for the annual maintenance of bank cards was transferred.

At the end of January (and then monthly during the year), the accountant makes the following entries:

DEBIT 91 sub-account "Other expenses" CREDIT 60 sub-account "Settlements with the bank"

2500 rub. (30,000 rubles: 12 months) - included in other expenses is the monthly cost of servicing bank cards;

DEBIT 60 subaccount "Settlements with the bank" CREDIT 60 subaccount "Calculations on advances issued"

2500 rub. - Advance paid.

Expenses related to the issuance and maintenance of bank cards do not reduce taxable income. Therefore, in accounting there is a constant difference and a constant tax liability.

In January, the accountant made a posting:

DEBIT 99 sub-account "Permanent tax liabilities" CREDIT 68 sub-account "Calculations for income tax"

1700 rub. ((6,000 rubles + 2,500 rubles) × 20%) - the amount of a permanent tax liability for the costs of issuing and servicing cards is reflected.

Starting from February, until the full repayment of the cost of annual servicing of bank cards, every month the accountant will make the following entry:

DEBIT 99 sub-account "Permanent tax liabilities" CREDIT 68 sub-account "Calculations for income tax"

500 rub. (2500 rubles × 20%) - reflects the amount of a permanent tax liability for the cost of servicing bank cards.

If an organization concludes an agreement with a bank for opening and servicing bank cards, then the costs of such services can be included in the calculation of income tax.

It is explained like this.

Employees of the organization using bank cards, in this case, are their holders, without acquiring any other rights, except for receiving funds transferred by the organization to the account (clause 1.9 of the Regulation approved by the Bank of Russia dated December 24, 2004 No. 266-P ). Therefore, the expenses of the organization for paying for bank services for the issuance and maintenance of salary cards cannot be regarded as expenses incurred in the interests of employees on the basis of paragraph 29 of Article 270 of the Tax Code of the Russian Federation.

The organization bears such costs in its own interests, because:

- a bank card is a means for carrying out payment and settlement transactions related to the fulfillment of the obligations of the employer to pay salaries;

- paying salaries in this way provides significant savings in the company's costs for the procedure for paying salaries:

1) there are no costs for the delivery of cash from banking institutions to the places of payment of wages and their protection during the period of transportation;

2) there is no need to additionally involve a separate accounting officer;

3) the staff is not distracted from the performance of their labor duties, etc.

Thus, the costs of opening and maintaining an account using bank cards are economically justified (clause 1, article 252 of the Tax Code of the Russian Federation).

The question of which item of expenditure to account for these costs is ambiguous.

In the letters of the Ministry of Finance of Russia dated July 14, 2009 No. 03-11-06 / 2/124 and the Federal Tax Service of Russia for the city of September 27, 2005 No. 18-11 / 3 / 68653 it is said that the costs of issuing and servicing bank cards can not be attributed to the cost of banking services.

The fact is that the list of transactions that can be attributed to banking is given in Article 5 of the Law of December 2, 1990 No. 395-1. Services for the issuance and maintenance of salary cards are not directly named in it. Therefore, it is impossible to take them into account as expenses for services rendered by banks (subclause 25, clause 1, article 264, subclause 15, clause 1, article 265 of the Tax Code of the Russian Federation).

Although these letters contain clarifications for organizations using simplified procedures, the conclusions drawn in them can be extended to organizations using the general

There are arguments that allow organizations to take into account the costs of opening and servicing bank cards when calculating income tax as expenses for banking services. They are as follows. Services for the issuance and maintenance of salary cards can be attributed to the number of banking operations, the costs of which are taken into account when calculating income tax (subclause 25, clause 1, article 264, subclause 15, clause 1, article 265 of the Tax Code of the Russian Federation).

This is due to the fact that Article 5 of the Law of December 2, 1990 No. 395-1 contains a list of banking operations, which is closed, as well as a list of transactions that a credit institution can make, which is open (paragraph 20, Article 5 of the Law of December 2, 1990 No. 395-1).

Thus, due to the ambiguity of the norms of the legislation and the clarifications of the regulatory agencies, the organization has the right to interpret the relevant norms in its favor (clause 7, article 3 of the Tax Code of the Russian Federation). This can lead to disagreements with the reviewers. However, in practice there are examples of court decisions made in favor of organizations (see, for example, the decisions of the Federal Antimonopoly Service of the Moscow District of October 7, 2008 No. KA-A40 / 8215-08, the Federal Antimonopoly Service of the Volga District of March 13, 2007 No. A12-11353 /06-C60).

However, in any case, the list of expenses that organizations can take into account when calculating income tax is not limited; article 265 of the Tax Code of the Russian Federation). Therefore, when other necessary conditions for recognition are met (in particular, documentary evidence of expenses), an organization can take into account the costs of issuing and servicing bank cards under subparagraph 49 of paragraph 1 of Article 264 (if such expenses are related to production and (or) sale) or subparagraph 20 of paragraph 1 Article 265 of the Tax Code of the Russian Federation (in other cases). At the same time, do not forget about the principle of uniformity.

The dates for the advance payment and wages are established by the collective agreement, the employment contract, as well as the internal labor regulations, but no later than 15 calendar days of the day for which it is accrued.

Step 1. Setting up advance payment and salary

In 1C ZUP 8.3, advance payment and salary dates are configured in the Settings section, Organization link: Settings –> Enterprise –> Organizations:

When you click on the Organization link, the Organization directory window opens. In this window, on the Accounting policy and other settings tab, using the Accounting and payroll link, go to the settings group, where we set the payment dates:

Step 2. Preparing for the advance payment

The amount of the advance in 1C ZUP is determined by one of three calculation methods:

- Fixed amount;

- Percentage of the tariff;

- Calculation for the first half of the month.

The advance payment method is indicated in the Hiring document of the Personnel section by clicking on the link Hiring, transfers, dismissals, or by clicking on the link Hiring: Personnel –> Create –> Hiring:

On the Remuneration tab, in the Advance payment field, by default, the advance payment method is set to Calculation for the first half of the month:

If the advance payment method is set to Fixed amount, then a field for entering the amount in rubles appears:

If the calculation method is set to Percentage of the tariff, then a field for entering percentages appears:

Step 3. How to change the calculation method or advance payment amount

In the future, you can change the method of calculation or the amount of the advance payment to the employee using the Change of pay or Personnel transfer documents.

The Change pay document is available in the Payroll section by clicking the Change pay for employees link:

In the opened form of the document Change remuneration, when the Change advance payment checkbox is checked, the fields for changing the method of calculation and the amount of the advance become available:

The Personnel Transfer document is available in the Human Resources section at the link Receptions, transfers, dismissals:

In the opened form of the Personnel transfer document, on the Payroll tab, when the Advance payment checkbox is selected, the fields for changing the method of calculation and the amount of the advance payment become available:

To change the calculation method and amount of the advance for the list of employees, use the Change advance payment document. This document can be found in the Salary section at the link of the same name:

Using the document Change advance in 1C 8.3 ZUP, you can temporarily change the advance. To do this, you need to add to the document form, using the command Change the form of the More button, an invisible by default element “by” from the Advance payment date group:

By clicking the Fill in button in the table of the document Change advance payment, employees of the organization working at the beginning of the month specified in the Change advance payment from field will be automatically selected.

If the Department field is filled in, then only employees of the selected department will be automatically selected in the tabular section. The composition of employees in the tabular section can be changed manually:

To set the advance payment method for the selected employees, assign the required value from the drop-down list in the Advance calculation method field:

When choosing the method of calculating the advance by Fixed amount or Percentage of the tariff for all employees in the tabular section:

- You can set the same amount of the advance by clicking the Set size button;

- The amount of the advance can also be adjusted manually in the Advance column:

If the advance payment calculation methods are set as Fixed amount or Percentage of the tariff, preliminary calculation before paying the advance payment is not required.

If the advance payment is calculated by Calculation for the first half of the month, a preliminary calculation of the advance is performed using the Accrual for the first half of the month document, taking into account the time worked by employees. This document is available in the Salary section at the All accruals link:

Also, the Accrual for the first half of the month document is available in the Salary section using the links Accrual for the first half of the month:

Document form in 1C ZUP 8.3:

Step 4. Preparing for the payment of the main part of the salary

Before paying the main part of the salary in 1C ZUP 8.3, it is necessary to perform a preliminary calculation using the document Payroll and contributions:

This document is available in the Salary section at the All accruals link:

Also, the document Payroll and contributions in 1C ZUP 3 is available in the Salary section at the link of the same name:

Step 5. Payment of advance payment and salary

The payment of the advance and the main part of the salary in 1C ZUP 3 (8.3) is carried out by special documents that are available in the Payments section at the appropriate links:

The use of a specific type of document in 1C ZUP 3 (8.3) is determined by the method of paying salaries:

- As part of the salary project - the Statement to the bank is used;

- By transfer to an arbitrary account in a bank - the List of transfers to accounts is applied;

- Via the cash desk - the Vedomosti to the cash desk is used.

The method of paying salaries in 1C ZUP 8.3 can be set for:

- All employees of the organization;

- Employees of any department of the organization;

- specific employee.

The payment method for all employees of the organization is specified in the Settings section, Organizations link: Settings –> Enterprise –> Organizations:

When you click on the Organization link, the Organization directory window opens. In the window that opens, on the tab Accounting policy and other settings, by clicking on the link Accounting and payroll - go to the settings group, where we set the method of paying advances and wages:

The method of payment to employees of any department of the organization is indicated in the Settings section, link Departments: Settings –> Enterprise –> Departments:

When you click on the Subdivisions link, the Subdivisions directory window opens. In the department card on the Accounting and payroll tab, go to the settings group, where we set the advance payment and salary payment method for the selected department:

The payment method for a particular employee is set in the employee card. The employee card is available from the Personnel section, link Employees: Personnel –> Employees:

Go to the settings group, where we set the method of advance payment and salary for a specific employee:

Important! In 1C ZUP 8.3, the payment method settings for an employee have a higher priority than the settings for a department or organization. And departmental settings take precedence over organizational settings.

That is, if the payment method is set for the organization Through the cashier, for the unit - Credit to the card, and for the employee - Transfer to the bank account, then the payment method for this employee will be Transfer to the bank account.

If the payment method is not set for the employee, then 1C ZUP 3 will choose the payment method set for the department in which the employee works.

And only if the payment method is not specified either for the employee or for the unit, then the 1C ZUP 3 (8.3) program will use the payment method established for the organization.

What to do if the payroll sheet in 1C ZUP 8.3 is not filled out, see our video:

Method of payment of wages within the framework of a salary project

A salary project is an agreement between an enterprise and a bank on the transfer of enterprise funds to personal accounts of employees centrally opened in this bank as part of a salary project. A company may have several payroll projects.

To pay salaries in this way in 1C ZUP 8.3, you must first enter into the directories:

- Salary projects - information about the salary project;

- Counterparties - information about the bank with which the contract was concluded;

- Bank accounts of counterparties - “salary” bank account.

A salary project in 1C ZUP 8.3 is created in the Payments section, following the link Payroll projects:

A form for filling in information about the salary project opens:

Directory Counterparties is available for filling in the Settings section, link Counterparties: Settings –> Directories –> Counterparties:

Clicking the Counterparties link opens a window in which the Create button opens a form for entering data about the counterparty. After filling in all the fields, click the Write button and, using the active link Set a bank account, select the “salary” account created in the directory Bank accounts of counterparties:

For employees who are paid to cards as part of a salary project, the personal account number for this project must be indicated. Personal accounts can be specified manually in the employee card, which is available in the Personnel section, link Employees: Personnel –> Employees:

Go to the settings group, where the personal account number is indicated in the Personal account number field, and the period from which the personal account is valid is entered in the Valid from field:

To enter personal accounts for several employees at the same time, a special form is used, which opens in the Payments section by clicking on the link Enter personal accounts:

Filling out the form in 1C ZUP 8.3:

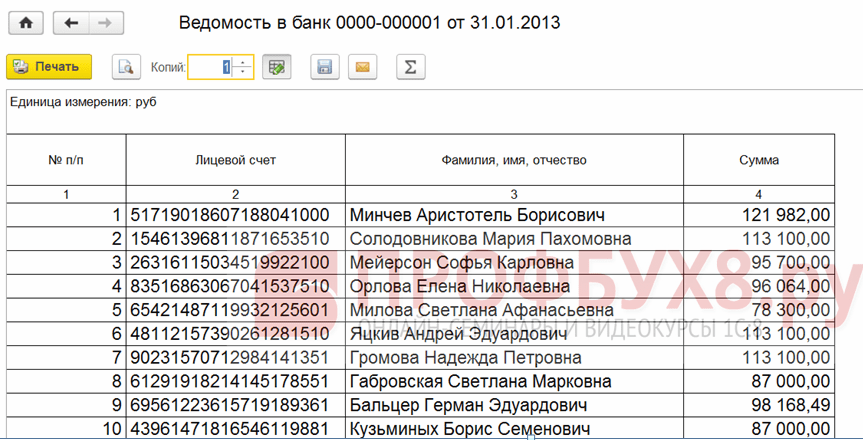

To pay salaries for a salary project in 1C ZUP, the Vedomosti to the bank document is used. This document can be found in the Payments section, by the link of the same name. When you click on the link, a window appears in which, by clicking the Create button, a new document, Statement to the Bank, is opened for filling out:

Also, the Statement to the bank document is available in the Payments section at the link of the same name:

When filling out the Statement to the bank document, you need to select the appropriate salary project. In the Pay field, the nature of the payment is indicated: Advance payment or Monthly salary, etc.:

By clicking the Fill button, the document table is filled in by employees who currently have the mark “Accounted to the card” and the selected salary project is indicated either in the employee card, or in the department card, or in the organization card:

If the salary project is not selected in the Statement to the bank document, then the tabular section is filled in by all employees whose salaries are transferred to the cards.

To create a printed form of the Statement to the Bank document, click the Print button on the document form and select the List of transfers item:

Method of payment of wages - By transfer to an arbitrary bank account

With this method, the salary is transferred to the plastic cards of employees without using the salary project. In this case, employees independently open bank accounts and provide the organization with account details.

To pay salaries by transfer to an arbitrary bank account in 1C ZUP 8.3, the document Sheet of transfers to accounts is used. This document is available in the Payments section, at the link of the same name:

Also, the Statement of transfers to accounts document is available in the Payments section, at the link of the same name:

When filling out the document Statement of transfers to accounts:

- By clicking the Fill button, the tabular part is filled in automatically by employees whose card indicates that the accounts are opened in this bank and there is a mark Transfer to a bank account:

- In the Bank field, select the appropriate bank:

- If the Bank field in the Statement of transfers to accounts document is not filled in, then all employees whose card indicates that the salary is paid by Transfer to a bank account will be automatically selected in the tabular section:

- In the Pay field, the nature of the payment is indicated: Advance payment, Monthly salary, etc.:

To generate a printed form of the document List of transfers to accounts, click the Print button on the document form and select the List of transfers item:

Method of payment of wages - through the cashier

You must first create cash registers in the Cashier directory. The specified directory is located in the Payments section, Cashiers link:

A new cash register in the directory is created using the Create button:

To pay salaries using the Via cash desk method, the Statement to the cash desk document is used. This document is located in the Payments section, following the link Statement to the cashier:

Also, the Statement to the Cashier document is available in the Payments section at the link of the same name:

If there is one cash desk in the organization, then in the Statement to the cash desk document, the Cash desk field is optional:

If the organization has two or more cash desks through which different employees are paid salaries, then in the Cash desk field, you must specify the corresponding cash desk through which a particular unit or employee is paid.

By clicking the Fill button, the tabular part is filled in by employees for whom the mark “Via cash desk” is currently set:

And the selected cash desk is indicated in the employee's card, or in the department's card:

Or in the organization card:

If the Cash desk field in the Statement to the cash register document is not filled in, then all employees who have the Via cash register checkbox will be automatically selected in the tabular section.

In the Pay field, the nature of the payment is indicated: Advance payment, Monthly salary, etc.

From the form of the document Statement to the cash register, by clicking the Print button, you can generate the following printables:

Hello dear blog readers. In the next article, we will talk about reflecting the procedure that is most pleasant for employees and heartbreaking for management - payment of wages in 1C ZUP. The program provides for the automation of two payment options: through the cashier and through the bank. There is also the possibility of simplified payment accounting, in which cash settlement orders (Expenditure Cash Order) or payment documents through the bank are not entered at all, and the salary is considered paid when posting the document "Payable". I wrote about this possibility of simplified accounting in the article in the section on the setting “Simplified accounting of mutual settlements”.

Today we will talk about the document "Salary payable", about "Account cash warrant" when reflecting payments through the cash desk and about a couple of documents “Outgoing payment order” + “Bank statement for salary transfer”, which register the payment of amounts through the bank. We will also talk about personal accounts and banks in 1C ZUP.

Payment of salaries through the cash desk in 1C ZUP

✅

✅

✅

To begin with, we will assume that in the "Accounting Options" on the tab "Salary payment" the checkbox is unchecked "Simplified accounting of mutual settlements"(I wrote more about this). Now, in order for the salary in the system to be considered paid, it will not be enough to post only a document "Payable" and it is necessary to enter a document on its basis "Account cash warrant". Let's create a new document "Salary payable". In general, I wrote about how to work in this document in an article from a series of review publications on the sequence of payroll in 1C ZUP:. So, in the new document, you need to fill in the following fields:

- Month of accrual- indicate the period for which the salary is paid. If the setting “Mutual settlements of salaries are carried out by months of its accrual” is set in the accounting parameters, then when filling out this document, only the amounts accrued in the specified accrual period will be taken into account. If this parameter is not set to the active position, then the document is filled out according to the principle of the balance of the debt to the employee at the end of the specified month of accrual. You can also read more about the specified setting of accounting parameters in the article that I already referred to a little earlier -.

- Payout method– can have two states “through the cash desk” and “through the bank”. The choice determines the set of document fields, attached printing forms, and also determines the document that will be created “based on” the current one: either “Outgoing cash order” or “Outgoing payment order”. We select the value "through the cashier".

- Payout field- determines where the program will take data from when filling out this document. We will select the “Salary” value, while the tabular part of the document will be filled with all accruals that have not been paid. There are also the values "Planned advance" and "Advance payment for the first half of the month", which I wrote about in the article. There are also values for making inter-settlement payments: “sick leave benefits”, “maternity leave”, “vacation”, “travel allowance” - when choosing these values, when filling out, the amounts accrued only for the corresponding types of accrual are requested. These are the main options for filling this field.

Next, press the button "Fill" and the tabular part of the document is filled in by all employees who were not paid wages in the specified accrual month. You can fill in employees according to a certain condition "Select by condition" or the "Select by list" list, as well as add manually.

Usually in practice it is done as follows. The calculator creates documents "Salary payable" for all employees. The document records but does not post. One of the forms (T-53 or T-49) is printed from the document and given to the cashier.

If some employee did not receive wages, then the value is set "Deposited".

Further, on the basis of the posted document “Salary payable”, a document is created and posted "Account cash warrant". If this is not done in 1C ZUP, then the salary will not be considered paid and the organization will remain indebted to these employees. So let's create a document. "Expenditure cash order" based on "Salary payable". In the created document, all required fields are filled in automatically. Manually, you only need to enter the cash register number field, since the program cannot know which number is free in the accounting department at the time of salary payment. Also note that the amount differs by the amount of the deposited payout.

After the cash settlement, the salary for these employees will be considered paid. In this case, the document "Salary payable" will be closed for editing. You can change it only after the cancellation of the "Expenditure cash warrant".

Also, on the basis of the document “Salary payable”, a document is created "Deposit Organizations" for deposited amounts.

Paying salaries through a bank in 1C ZUP

✅ Seminar "Life hacks for 1C ZUP 3.1"

Analysis of 15 accounting life hacks in 1s zup 3.1:

✅ CHECK LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll in 1C ZUP 3.1

Step by step instructions for beginners:

Now, using the example of the same employees, we will figure out how payment through the bank is reflected in 1C. Also, in the accounting parameters, the checkbox must be unchecked. "Simplified Accounting of Mutual Settlements". Before reflecting the payment through the bank, you must fill in information about the personal accounts of employees. As a rule, an organization enters into an agreement with a certain bank for the payment of wages to its employees on plastic cards of this bank. And a personal account is registered for each employee. These accounts must be entered into the program. To do this, open the form of the information register of the same name. In the full interface, access to the register can be obtained from the main menu items "Payroll for organizations" -> "Cashier and bank" -> "Personal accounts of employees of the organization".

Let only two of the three employees who participate in the example have personal accounts. In this case, it is necessary to create a Bank in the corresponding directory and fill in information about it.

After that, we press the “Fill” button and the tabular part is filled in by those employees who have accrued and unpaid amounts, as well as those to whom we indicated accounts a little earlier for this very bank (Ivanov did not get, although the organization has a debt to him).

We post the document and on the basis of it we create the document "Outgoing payment order". All fields of this document will be filled in automatically, but you will have to fill in the number of the payment order manually, since the ZUP is not aware of which numbers are occupied and free in 1C Accounting. Also note the two score fields. The top one indicates the number of the organization's regular account opened with this bank. For automatic completion, it must be listed in the "Organizations" directory for our organization. But in the field below, the so-called “salary account” is indicated, which is opened when concluding a contract for the payment of wages through a bank. Funds for the payment of salaries to employees are received into this account in a cumulative amount. In the program, this account is indicated in the directory element "Contractors: Banks". We used the bank from this directory when filling out information about the personal accounts of employees a little earlier.

We carry out the document "Outgoing payment order". I would like to point out that while the salary is not considered fulfilled.

Uploading payment orders to 1C ZUP using the processing "Import / export of operations on personal accounts"

✅ Seminar "Life hacks for 1C ZUP 3.1"

Analysis of 15 accounting life hacks in 1s zup 3.1:

✅ CHECK LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll in 1C ZUP 3.1

Step by step instructions for beginners:

Now we need to upload this payment order in XML format, in order to send it through one of the bank's clients for execution to the bank. For this, the program has a special processing "Import / export of operations on personal accounts". It can be accessed along the same path as the register with personal accounts, with which we worked a little earlier. Open the processing and go to the bookmark "Export payroll". In the "Export directory" field, specify the path where we want to save the XML file. The number of the "Branch" and the "Agreement Number" of the bank will also have to be specified manually, for some reason the 1C programmers did not implement the storage of this data in some directory. The tabular part should reflect our payment order. Put a tick in front of it and click the "Unload" button.

As a result, an XML file will be generated in the specified directory. This file is sent to the bank through the client bank. In fact, it states that a certain amount must be transferred from the organization’s current account to the organization’s salary account and distributed among the personal accounts of the specified employees.

After the bank fulfills this order, it is necessary to create a document in 1C ZUP on the basis of the "Payment order" document Bank statement for salary transfer.

We carry out this document and now the salary of employees is considered paid. It turns out that for the payment it is necessary to complete a chain of 3 documents:

That's all for today! Soon there will be new interesting materials on.

To be the first to know about new publications, subscribe to my blog updates:

Transfer of wages to the employee's card regulated by Article 136 of the Labor Code of the Russian Federation, which obliges the employer to pay wages at the place where the employee works, that is, if translated from legal language into Russian, then payment is made in cash at the employer's cash desk, namely where the employee works. But most often wages are paid by bank transfer.

And Article 136 of the Labor Code of the Russian Federation tells us that - "it is paid to the employee, as a rule, at the place where he performs work or is transferred to the credit institution specified in the employee's application, on the terms determined by the collective agreement or labor contract."

The employee has the right to change the credit institution to which the wages are to be transferred by informing the employer in writing about the change in the details for the transfer of wages, but no later than five working days before the day of payment of wages.

The place and terms of payment of wages in non-monetary form are determined by the collective agreement, local regulations of the employer or the employment contract.

So, the transfer of wages to the employee’s card, namely to which account, is decided by the employee himself, and not by the employer.

It is illegal when an organization has a salary project and forces all its employees to connect to this particular salary project. For many years of work in personnel, I had to face a situation where, when hiring an employee, you have to say: “Let's decide with you the question of how to draw up wages. The employee spreads bank cards on the table with a fan and asks: “Which bank do you have a salary project with, let's pick up a card. I had a card left from each employer, I didn’t close the card and there was some money left in the account. Therefore, let's select the bank whose bank card I have available, I don't need another card."

Now, upon employment, the employee already has a bank card, to which he is ready to receive wages.

Labor legislation says that this is the employee's money, it is he who decides how it is more convenient for him to receive it, in which bank and to which personal account. At the same time, the employee has the right to change the banking organization by notifying the employer of this only 5 days before the day preceding the transfer of wages.

A situation may arise when an employee has several bank cards from different banks, he has a loan on one card and it is convenient for him that the bank debits a certain amount from his personal account, with the second card it is convenient for him to travel abroad, another card of Sberbank, whose ATMs are located on every corner and it is convenient for me to use the map in my current life. Therefore, the employee asks to transfer wages for one period to one card, for another period to transfer to the second card, and wages for the next period - to the third card and then repeat.

This is the right of the employee and he himself decides to which account to transfer his wages. And since wages are transferred every two weeks, the employee has the right to change the banking organization every two weeks, the main thing is that he has time, at least 5 days in advance, to notify you of this in writing, indicating the new bank details and the account to which payroll needs to be transferred.

The accounting department, in turn, is obliged to transfer the employee's salary to the account indicated by the employee in his application. This condition must necessarily be reflected in the employee's employment contract and he must be aware of his right when changing a banking organization.

Yes, we do not like an accountant when they create unnecessary gestures and refer to the fact that this is not possible, and that it is done only according to the salary project of the organization. But this is not so, the accountant in this case is cunning, since any program that automates payroll allows you to enter an unlimited number of salary projects and make a choice on which card and which banking organization to transfer wages to the employee.

Once again I want to remind you that this is the money of the employee and it is up to him to decide where to transfer it. As convenient as we do for the employee.

Now, when applying for a job, you will not have questions about transfer of salary to the employee's card.