How to issue an invoice to a tax agent. Reflection of VAT accounting in the performance of duties of a tax agent? VAT accepted for deduction

In what order is an invoice issued when a Russian buyer performs the duties of a tax agent? We pay a foreign organization for a trademark, thereby acting as a tax agent for paying VAT to the budget. How are invoices received and invoices issued filled out?

In this case, the received invoice is not filled in.

When drawing up an invoice, the Ministry of Finance of Russia recommended making a note “For a foreign person” on them (letter dated May 11, 2007 No. 03-07-08 / 106).

In line 2 "Seller" of the invoice, your organization must provide the full or abbreviated name of its organization (specified in the agreement with the tax agent), for which you are fulfilling tax obligations.

Line 2a "Address" must contain the address (in accordance with the constituent documents) of the seller (specified in the agreement with the tax agent), for which you fulfill the obligation to pay tax.

Line 2b "TIN / KPP of the seller" must contain a dash.

In lines 3 "Consignor and his address" and 4 "Consignee and his address" tax agents purchasing works (services) from foreign organizations put dashes.

In line 5, indicate the number and date of the payment document confirming the transfer of the withheld VAT amount to the budget. In line 7 "Currency: name, code" indicate the name of the currency according to the All-Russian Classifier of Currencies and its digital code

In case of partial payment, dashes are put in columns 2–4, and columns 10–11 are not filled in.

The rationale for this position is given below in the materials of the Glavbukh System

1.Situation:How to fill out an invoice for a tax agent

In line 2 “Seller”, tax agents purchasing goods (works, services) from foreign organizations that are not tax registered in Russia (clause 2, article 161 of the Tax Code of the Russian Federation, paragraph 3 of article 161 of the Tax Code of the Russian Federation), give the full or abbreviated name the seller or lessor (specified in the agreement with the tax agent), for whom they perform tax obligations.*

Line 2a "Address" must contain the address (in accordance with the constituent documents) of the seller or lessor (specified in the agreement with the tax agent), for which tax agents fulfill the obligation to pay tax.

In line 2b "TIN / KPP of the seller" must be affixed:

- dash - if the invoice is filled in by a tax agent who purchases goods (works, services) from a foreign organization that is not tax registered in Russia (clause 2 of article 161 of the Tax Code of the Russian Federation); *

- TIN and KPP of the seller or lessor (specified in the agreement with the tax agent), for which the tax agent fulfills the obligation to pay tax, in all other cases (clause 3 of article 161 of the Tax Code of the Russian Federation).

When drawing up an invoice for work performed (services rendered) in lines 3 "Consignor and his address" and 4 "Consignee and his address" tax agents purchasing works (services) from foreign organizations that are not tax registered in Russia (p 2 article 161 of the Tax Code of the Russian Federation), as well as tax agents renting state or municipal property directly from state authorities and local governments or acquiring (receiving) state or municipal property in Russia that is not assigned to state (municipal) organizations (p. 3, article 161 of the Tax Code of the Russian Federation), put dashes.*

Some features have the order of filling in line 5 "To the payment and settlement document".

When purchasing works (services) from foreign organizations that are not tax registered in Russia, in line 5 indicate the number and date of the payment document confirming the transfer of the withheld VAT amount to the budget.*

In line 7 “Currency: name, code”, indicate the name of the currency according to the All-Russian Classifier of Currencies and its digital code * (subparagraph “m”, paragraph 1 of Appendix 1 to). If the price of goods (work, services) in the contract is indicated in a currency and its payment is also made in a currency, the tax agent can draw up an invoice in a currency (clause 7, article 169 of the Tax Code of the Russian Federation).

When filling out the invoice columns, tax agents who purchase goods (works, services) from foreign organizations that are not tax registered in Russia (clause 2 of article 161 of the Tax Code of the Russian Federation), as well as tax agents who rent state or municipal property directly from bodies of state power and local self-government or acquiring (receiving) state or municipal property in Russia that is not assigned to state (municipal) organizations (clause 3 of article 161 of the Tax Code of the Russian Federation) must adhere to the following rules.

In case of full payment for goods (works, services), the columns of the invoice should be filled in in the manner prescribed by clause 5

In case of partial payment, dashes are put in columns 2-4, and columns 10-11 are not filled in. *

For both full and partial payment (including non-monetary payments), please indicate:

- in column 1 - the name of the supplied goods, property rights (description of work, services);

- in column 7 - the estimated tax rate (10/110 or 18/118) or the entry "Without VAT";

- in column 9 - the sum of the indicator in column 5 and the indicator calculated as the product of the indicator in column 5 and the tax rate in the amount of 10 or 18 percent, divided by 100;

- in column 8 - the amount of tax calculated as the product of columns 9 and 7, in rubles and kopecks without rounding (letter of the Ministry of Finance of Russia dated April 1, 2014 No. 03-07-РЗ / 14417);

- in column 6 - the amount of excise, and if the goods are not excisable, then indicate "Without excise".

This procedure for filling out invoices is established in Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

After filling in all the required details of the invoice, drawn up on paper, it must be signed by the head and chief accountant of the organization - tax agent (other persons authorized to do so by order of the head or power of attorney on behalf of the organization). If the tax agent is an entrepreneur, he must personally sign the invoice and indicate in it the details of his certificate of registration. This procedure is established by paragraph 6 of Article 169 of the Tax Code of the Russian Federation.

With regard to the preparation of the previous forms of invoices, similar explanations were contained in the letter of the Federal Tax Service of Russia dated August 12, 2009 No. ShS-22-3 / 634.

When calculating tax, as well as when issuing an advance (partial payment), including in non-monetary form, tax agents purchasing goods (works, services) from foreign organizations that are not tax registered in Russia (clause 2 of article 161 of the Tax Code RF), as well as tax agents renting state or municipal property directly from state authorities and local governments or acquiring (receiving) state or municipal property in Russia that is not assigned to state (municipal) organizations (clause 3 of article 161 of the Tax Code of the Russian Federation), draw up an invoice and register it in the sales book (clause 15 of section II of Appendix 5 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). When presenting VAT for deduction in accordance with paragraph 3 of Article 171 of the Tax Code of the Russian Federation, they register previously issued invoices for advance payment (partial payment) in the purchase book (paragraph 23 of section II of Appendix 4 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

Olga Tsibizova

2.Situation:How to draw up an invoice for a tax agent if he purchases goods (works, services) from a foreign organization that is not tax registered in Russia

Draw up an invoice in the manner prescribed by paragraphs, 5.1 and Article 169 of the Tax Code of the Russian Federation, taking into account some features.). *

At the same time, some positions of invoices drawn up by tax agents are filled in a special order. For example, in line 2b "TIN / KPP of the seller" you need to put a dash (clause 1 of Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). With regard to filling in the previous forms of invoices, as additional information, the Ministry of Finance of Russia recommended that they be marked “For a foreign person” (letter dated May 11, 2007 No. 03-07-08 / 106). *

An example of drawing up an invoice by a tax agent when he purchases services from a foreign organization. A foreign organization is not tax registered in Russia

Alpha LLC (customer) entered into an agreement with the Ukrainian organization Lawyers of Ukraine (executor) for the provision of legal services that are necessary for production activities subject to VAT. The cost of services under the contract is USD 11,800 including VAT. The Ukrainian organization is not tax registered in Russia. The place of sale of legal services is Russia (subclause 4, clause 1, article 148 of the Tax Code of the Russian Federation). Therefore, their value is subject to VAT.

The services were rendered from 13 to 15 March. On March 15, the parties signed an act of acceptance and transfer of services rendered. On the same day, Alfa's accountant transferred the payment to the Ukrainian organization and drew up an invoice marked "For a foreign person." At the same time, filling out line 2b “TIN / KPP of the seller” of the invoice, the accountant of Alpha put a dash. The amount of VAT that Alfa must withhold from the income of the Ukrainian organization as a tax agent is $1,800 ($11,800 × 18/118). VAT withheld from the income of the Ukrainian organization was transferred to the budget by payment order. The accountant of Alfa indicated the details of this payment document in line 5 of the drawn up invoice.

The following entries were made in Alpha accounting.

Debit 26 Credit 60

- 330,000 rubles. ((11,800 USD – 1,800 USD) ? 33 RUB/USD) – expenses for legal services rendered are reflected (based on the act of acceptance and transfer);

Debit 19 Credit 60

- 59,400 rubles. (1800 USD ? 33 RUR/USD) - including VAT on the cost of services to be withheld when paying income to a Ukrainian organization;

Debit 60 Credit 68 sub-account "VAT calculations"

- 59,400 rubles. - VAT withheld from the amount payable to a Ukrainian organization that is not tax registered in Russia;

Debit 60 Credit 52

- 330,000 rubles. – the payment to the Ukrainian organization was transferred (net of withheld VAT);

Debit 68 subaccount "VAT settlements" Credit 51

- 59,400 rubles. - the amount of VAT withheld was transferred to the federal budget;

Debit 68 subaccount "VAT settlements" Credit 19

- 59,400 rubles. - accepted for deduction of VAT deducted from income payable to a Ukrainian organization and transferred to the budget.

Olga Tsibizova, Deputy Director of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia

- Download forms

After all, such an error does not interfere with identifying the seller, buyer, name of goods, works, services or property rights, their cost, rate and amount of tax. This is indicated in paragraph 2 of paragraph 2 of Article 169 of the Tax Code of the Russian Federation. Similar clarifications are contained in the letters of the Ministry of Finance of Russia dated May 26, 2015 No. 03-07-09 / 30177 and the Federal Tax Service of Russia dated December 10, 2012 No. ED-4-3 / 20872. Form and procedure for filling out The form of an adjustment invoice and the Rules for filling it out are given in Appendix 2 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. Use it. However, you have the right to add additional information to the document. The main thing is to keep the lines, columns, values and details of the approved form. You can create adjustment invoices on paper or electronically. The electronic format of the document was approved by order of the Federal Tax Service of Russia dated March 4, 2015 No. ММВ-7-6/93.

Accounting and legal services

Situation: can a tax agent, having drawn up a corrective invoice, deduct excess VAT paid to the budget? He is a tenant of state or municipal property. The landlord reduced the amount of rent retroactively, starting from January 1 of the current year.

Yes maybe. As a general rule, when the cost of services decreases, the contractor (in this case, the lessor) must issue an adjustment invoice to the customer (tenant). The executor registers this document in the purchase book and deducts the excess VAT amount.

The customer who has received the adjustment invoice registers it in the sales book and recovers part of the input tax that was previously deductible.

The tax agent must issue an adjustment invoice to the buyer

The right of tax agents to draw up adjustment invoices is not expressly stated either in Article 169 of the Tax Code of the Russian Federation or in Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. But given that in this situation the tenant actually performs the duties of a VAT payer, he can use as a general rule and adjust their tax liabilities in the same manner as provided for sellers (executors).

Attention

The only difference is that the tax agent will have to register an adjustment invoice in both the sales book and the purchase book. If the tenant applies a special tax regime, then he is not recognized as a VAT payer and has no right to a deduction.

2 tbsp. 346.11, paragraph 4 of Art. 346.26, paragraph 1 of Art. 171 of the Tax Code of the Russian Federation). Therefore, he registers the invoice compiled by him only in the sales book.

Ka. adjustment of the invoice issued by the tax agent

Based on the application, the tax inspectorate will have to correct the accrual data in the tax agent's personal account card and return the overpayment in accordance with article 78 of the Tax Code of the Russian Federation (clause 14 of article 78 of the Tax Code of the Russian Federation). How to make corrections If an error is made in the correction invoice, then the document must be corrected.

The procedure for making corrections to corrective invoices is given in paragraph 6 of Appendix 2 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. For more information, see How to correct an invoice.

When compiling adjustment invoices, it is not necessary to correct the indicators in the original invoice to which the adjustment invoice was drawn up (clause 7 of Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

Tax agent invoice in 1s 8.3 accounting 3.0

Fig.15 Lease and sale of property Registration of VAT transactions in the sale of property and lease of municipal property has no fundamental differences from the above scheme. The main thing is to choose the right type of agency agreement (Fig. 16).

Fig. 16 In addition, when drawing up a document for the receipt of rental services, you must correctly specify the accounts and cost analytics (Fig. 17). Fig.17 Postings are shown in Fig.18. They also have a special account 76.NA.

Fig. 18 When selling property by a tax agent, it is also important to choose the right type of agency agreement and follow the rules for accounting for fixed assets.

Working with corrective invoices

- number and date of the primary invoice, the indicators of which have been changed;

- quantity of goods, scope of works, services or property rights before and after their changes;

- price, tariff before and after adjustment;

- the value of the entire quantity of goods, works, services or property rights, including and excluding VAT, before and after the changes;

- the amount of excise before and after clarification - in relation to excisable goods;

- the amount of VAT before and after clarification;

- positive or negative differences resulting from the clarification of the cost of goods, works, services, the amount of VAT and excises (if excisable goods were shipped).

A complete list of mandatory indicators of the adjustment invoice is given in paragraph 5.2 of Article 169 of the Tax Code of the Russian Federation.

This follows from the provisions of paragraph 3 of article 168 of the Tax Code of the Russian Federation and paragraph 3 of section II of Appendix 5 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. Section III of the declaration, which reflects the amount of deductions, tax agents who are not VAT payers are not fill in (paragraph 11, clause 3 of the Procedure approved by order of the Ministry of Finance of Russia dated October 29, 2014 No. MMV-7-3 / 558). But given that the tax agent is a tenant and in this case performs the duties of a taxpayer-lessor, with a decrease in the cost of services, he can also issue an adjustment invoice. And since such a tax agent does not have the right to deduct, in order to return the overpaid amount of VAT, he should apply to the tax office with an appropriate application (clause 6, article 78 of the Tax Code of the Russian Federation).

Correction of the invoice with the tax agent

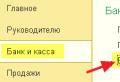

Fig. 2 In the postings to reflect VAT, instead of the usual settlement account, a new subaccount is used - 76.NA. Fig. 3 To generate invoices of this type, processing is used, which is called from the corresponding item in the “Bank and cash desk” section (Fig. 4).

Fig.4 Fig.5 shows the form of this processing. All incoming invoices issued under agency agreements and paid in the selected period will automatically fall into the tabular section (the “Fill” button in Fig. 5). By clicking the "Run" button, invoices will be generated and registered.

Fig.5 The following figure shows the invoice itself (Fig.6). Note that the VAT rate is selected as "18/118", and the operation code in this case is 06.

Fig. 6 As you can see, the postings (Fig. 7) involve new sub-accounts specially added to the chart of accounts 1C (76.HA and 68.32).

Fig. 7 The amount of VAT that we must pay to the budget can be checked in the report "Sales Book" and in the "VAT Declaration". The sales book (Fig. 8) is formed in the "VAT reports" section. The "Counterparty" column indicates the organization that pays the tax.

Get 267 1C video lessons for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- A good course on 1C Trade Management 11.

Fig. 8 The VAT declaration in 1C is formed from the Reporting section. In the "Regulated reports" subsection, select the appropriate type ("VAT declaration"). Line 060 (p. 1 Section 2) will be filled in with the amount to be paid to the budget (Fig. 9). Fig. 9 Payment of tax to the budget is formalized by standard documents 1C (“Payment order” and “Debit from the current account”).

Info

In a single adjustment invoice, when changes affect the indicators of several primary documents, indicate the numbers and dates of each of them. Moreover, the quantity and volume of homogeneous goods, works, services and property rights can be indicated in total.

An example of issuing a single adjustment invoice to reduce the cost of shipped goods specified in several invoices drawn up earlier. The seller, OOO Trading Firm Germes, and the buyer, JSC Alfa, entered into an agreement for the supply of the following goods:

- non-carbonated water - at a price of 30 rubles. for a bottle;

- sparkling water - at a price of 15 rubles. for a bottle.

- 20,000 bottles of non-carbonated water with a total value (excluding VAT) of 600,000 rubles. (20,000 bottles × 30 rubles);

- 10,000 bottles of sparkling water with a total value (excluding VAT) of 150,000 rubles. (10 000 bot.

In this case, the changes are taken into account when compiling the primary document;

- the buyer - VAT payer returns the goods that he managed to take into account. In this case, the reverse occurs. So, the buyer draws up the most common invoice;

- the original invoice was erroneously issued to the buyer.

In this case, proceed in the same way as when re-invoicing for the same operation. That is, cancel the erroneous entry in the sales book, and inform the buyer that the document was issued by mistake.

Such clarifications are contained in the letters of the Ministry of Finance of Russia dated March 16, 2015 No. 03-07-09 / 13813, dated June 18, 2014 No. 03-07-RZ / 29089, dated May 16, 2012 No. 03-07-09 / 56, dated December 5, 2011 No. 03-07-09/46, dated December 1, 2011 No. 03-07-09/45, dated November 30, 2011 No. 03-07-09/44 and the Federal Tax Service of Russia dated March 12, 2012 No. ED-4-3/4143.

For the shipped goods, Hermes issued an invoice to Alfa and registered it in the sales book. On June 21, Hermes shipped:

- 40,000 bottles of still water with a total value (excluding VAT) of 1,200,000 rubles. (40,000 bottles × 30 rubles);

- 20,000 bottles of sparkling water with a total value (excluding VAT) of 300,000 rubles. (20,000 bottles × 15 rubles).

For the shipped goods, Hermes issued an invoice to Alfa and registered it in the sales book. On July 10, Hermes shipped another consignment of goods to Alfa for a total of 800,000 rubles. (without VAT). Under the terms of the contract, upon reaching the volume of purchases in the amount of more than 3,000,000 rubles. Hermes provides the buyer with a discount on previously shipped products in the amount of 10 percent of its total cost. On July 10, Hermes reflected the discount provided in a single adjustment invoice for invoices dated February 17 and June 21.

In 1C 8.3 configurations, several main types of VAT accounting by tax agents are implemented:

- Payment of VAT when purchasing goods from a foreign company (non-resident)

- Rent

- Sale of property

Accounts 76.HA and 68.32 are used in the chart of accounts to record the operations of tax agents.

Consider the features of registration of invoices by tax agents.

Payment of VAT when purchasing goods from a foreign supplier (non-resident)

When buying imported goods, the main thing is to correctly fill in the parameters of the contract:

- type of contract;

- sign "Organization acts as a tax agent";

- type of agency agreement.

The receipt document is drawn up in the same way as for any other goods (Fig. 2), but, unlike regular receipt invoices, you do not need to create an invoice.

In postings to reflect VAT, instead of the usual mutual settlement account, a new subaccount is used - 76.NA.

To generate invoices of this type, processing is used, which is called from the corresponding item in the "Bank and cash desk" section (Fig. 4).

Figure 5 shows the form of this processing.

All incoming invoices issued under agency agreements and paid in the selected period will automatically fall into the tabular section (the “Fill” button in Fig. 5).

By clicking the "Run" button, invoices will be generated and registered.

The following figure shows the invoice itself (Fig. 6). Note that the VAT rate is selected as "18/118", and the operation code in this case is 06.

As you can see, the postings (Fig. 7) involve new sub-accounts, specially added to (76.HA and 68.32).

The amount of VAT that we have to pay to the budget can be checked in the Sales Book report and in the VAT Declaration.

(Fig. 8) is generated in the "VAT Reports" section

The column "Counterparty" indicates the organization that pays the tax.

Get 267 1C video lessons for free:

Formed from the Reporting section. In the "" subsection, you need to select the appropriate type ("VAT declaration").

Line 060 (p. 1 Section 2) will be filled in with the amount to be paid to the budget (Fig. 9).

The payment of tax to the budget is formalized by standard documents 1C ("Payment order" and ""). Both documents must have the type of operation "Tax payment" (Fig. 10).

When writing off money, it is important to indicate the same account as when calculating tax - 68.32 (Fig. 11).

Finally, VAT can be deducted. Postings are created by the document "Formation of purchase book entries":

Operations –> Regulatory VAT operations –> Formation of purchase book entries –> “Tax agent” tab (Fig. 12).

After posting the document "Formation of records ..." (postings are shown in Fig. 13), you can create a book of purchases. This report is called in the same way as the "Sales book" report from the VAT Reports section.

The column "Name of the seller" does not include the agent, but the seller himself (Fig. 14).

Section 3 of the VAT declaration (Fig. 15) will contain amounts that can be deducted from the operations of tax agents.

Rent and sale of property

Registration of VAT transactions when selling property and renting municipal property has no fundamental differences from the above scheme.

The main thing is to choose the right type of agency agreement (Fig. 16).

In addition, when drawing up a document for posting rental services, you must correctly specify the accounts and cost analytics (Fig. 17).

Postings are shown in Fig.18. They also have a special account 76.NA.

The tax agent's VAT is taken into account if:

the purchase of goods is carried out in foreign currency from a non-resident;

the property is leased;

the property is for sale.

Accounts 76.HA and 68.32 are used to account for VAT. We propose to analyze all three situations and determine the peculiarity of the invoice.

The main condition for the purchase of goods in foreign currency from a non-resident is the correct completion of the contract parameters:

Type of contract - indicate "With a supplier";

The organization acts as a tax agent for the payment of VAT - check the box;

Type of agency agreement - indicate, "Non-resident".

We process the receipt of goods in a standard way, but without registering an invoice:

In the movement of the document, subaccount 76.HA will be used, and not the usual mutual settlement account.

To reflect VAT, special processing will be used, which can be found on the menu tab "Bank and cash desk" section "Registration of invoices" magazine "Invoices of the tax agent":

We open the form. It is only necessary to set the period and the name of the agent organization (if the 1C program is used for accounting of several companies at the same time, for example, when using 1C online remotely). The filling is automatic by clicking "Fill", while the tabular part will display all the necessary documents.

By clicking "Run", invoices will be generated and registered:

In the form of an invoice, let's pay attention to the specified VAT rate - "18/118" and the designation of the operation code - 06.

Postings will reflect special accounts 76.HA and 68.32, which are added to the chart of accounts:

The VAT amount for mandatory payment to the budget is checked through the Sales Book report and through the VAT Declaration document. The "Sales book" report is generated in the "VAT reports" section.

At the same time, the period of formation and the name of the taxpayer organization are indicated:

The formation of the VAT declaration is carried out in the "Reporting" section, the item "Regulated reports", "VAT declaration". The value of the amount for payment will be reflected on page 1 section 2 in line 060:

The tax is paid through standard documents of the 1C program "Payment order" and "Debit from the current account", in which the "Type of operation" - "Payment of tax" must be indicated.

Please note that for the correct write-off of VAT, you must specify account 68.32.

After that, we accept VAT deduction. Go to the menu tab "Operations" section "Regulatory VAT operations".

We create the document "Formation of purchase book entries" and open the "Tax agent" tab:

We post the document and watch the movement on the document "Formation of purchase book entries":

Then we proceed to the formation of the "Purchase Book" document, which is located in the "VAT Reports" section. The column "Name of the seller" will appear not the agent organization, but the seller organization:

If you view the declaration, then on page 1 section 3 of term 180 you can see the value of the amount to be deducted for the operation of the tax agent:

The sale of property through a tax agent is formalized with an indication of the correct type of contract and in compliance with the OS accounting rules:

Below is the sequence of registration for the accounting of invoices by a tax agent:

creation of an agency agreement;

posting of goods or services with the specified contract;

payment for goods or services to a supplier

registration of the invoice of the tax agent;

payment of VAT to the budget;

acceptance of VAT for deduction through the document "Formation of purchase book entries".

Value added tax is paid when selling goods, works, services on the territory of Russia when applying the general taxation system for an organization and OSNO for an individual entrepreneur.

However, in the course of business activities, an enterprise may experience situations when a supplier that pays VAT cannot pay tax to the budget of the Russian Federation. In this case, the buyer acts as a tax agent for the payment of VAT to the budget.

All these situations are described in article 161 of the Tax Code of the Russian Federation (part 2; section 8; chapter 21):

- Purchase of goods, works, services from non-residents on the territory of the Russian Federation;

- Renting or acquiring ownership of property from state bodies;

- Realization of confiscation, treasures, ownerless objects;

- Provision of intermediary services on the territory of the Russian Federation for non-residents;

- Acquisition of a vessel not registered in the register within 45 days from the date of the transaction;

- Realization of raw skins of animals, aluminum and its alloys, scrap and waste of non-ferrous metals.

The fulfillment of the duties of a tax agent in the event of the above situations is assigned both to VAT payers and to individuals and organizations that apply special tax regimes, as well as those exempted from paying this tax (Article 145 of the Tax Code of the Russian Federation).

To reflect the operations of accounting for the activities of a tax agent in the 1C system, a general scheme is used, which we will now describe.

When making payment, partial payment, prepayment to the supplier, the invoice of the tax agent is registered - the documents “Debit from the current account” with the operation “Payment to the supplier” are entered into the 1C system, and the “Invoice received” generated on the basis of this document with an operation code of the form "06" - Tax agent, Art. 161 NK. For certain transactions, for example, if the buyer acts as a tax agent under municipal property lease agreements, tax agent invoices are generated by special processing.

When posted, the document will make movements on account 68.32 “VAT in the performance of duties of a tax agent” and on the accumulation register “VAT Sales”.

The delivered goods, work, service are accepted for accounting with the buyer; the previously paid advance payment to the supplier is accepted for offset - the document “Receipt (acts, invoices)” is generated, the invoice presented by the supplier (if required) is registered by hyperlink in the receipt document.

The VAT presented by the supplier was transferred by the tax agent to the budget of the Russian Federation - the document “Write-off from the current account” was generated with the operation “Payment of tax”.

- Sales book (generated automatically when posting a tax agent invoice) - here the VAT allocated in the tax agent invoice is registered, i.e. the amount of VAT paid by the tax agent to the budget of the Russian Federation for the supplier;

- Purchase book (it is required to enter the VAT regulatory operation “Formation of a purchase book entry” with filling in the “Tax agent” tab) - VAT is registered here, which the buyer-tax agent has the right to deduct on the basis of Art. 171 of the Tax Code of the Russian Federation. Please note that an entry on the application of a tax deduction will be generated in the purchase book only if there is a tax payment to the budget (that is, the previous paragraph of this scheme has been completed).

Of course, the described scheme is too general, and for different business transactions in which the enterprise acts as a tax agent, there are different solutions in the 1C system, but the format of this article does not imply consideration of all possible situations and their implementation in 1C software products.

Let us consider in more detail the operation for the sale of raw animal skins, aluminum and its alloys, scrap and waste of non-ferrous metals, since this is a new provision of Article 161 of the Tax Code of the Russian Federation, which comes into force on January 1, 2018.

From this date, all buyers, with the exception of individuals who are not individual entrepreneurs, when purchasing raw hides and scrap in Russia from organizations paying VAT (if they have not received an exemption from VAT), are tax agents for this tax.

VAT is calculated by the tax agent at the estimated tax rate. The amount of VAT to be paid to the budget is determined in aggregate, based on the sum of all transactions of the tax agent for the past tax period.

The moment of determining the tax base for such payers is:

- Day of shipment (transfer) of goods, works, services;

- The day of payment (prepayment) against the forthcoming receipts of goods, works, services.

How is this operation implemented in 1C 8.3?

Let's open the section "Reference books" / subsection "Purchases and Sales" / "Agreements". In the card of the counterparty agreement with the type of agreement “With a supplier”, we will configure the “VAT” part:

- Set the flag "The organization acts as a tax agent for the payment of VAT";

- Let's choose the type of agency agreement "Sale of goods" (clause 8, article 161 of the Tax Code of the Russian Federation).

Postings on advance payment transactions are formed in the system by debiting documents from the current account in the section "Bank and cash desk" / subsection "Bank" / magazine "Bank statements".

The document "Write-off from the current account" generates a posting on the debit of account 60.02 and the credit of account 51 for the amount of the advance payment transferred to the supplier.

At the time the supplier receives payment for the upcoming supply of scrap metal, the buyer must fulfill the duties of a tax agent for calculating VAT, and the seller must issue an invoice for the advance payment received, excluding VAT amounts, with the note “VAT is calculated by the tax agent”.

To register this operation, it is necessary to enter the document "Invoice received" on the basis of the document "Debit from the current account". The document will show:

- The amount of the advance payment transferred to the supplier, taking into account the amounts of VAT (in our example, this is 50,000 rubles + 50,000 * 18% (VAT rate for the current date)) - 59,000 rubles;

- Estimated VAT rate - 18/118;

- VAT amount - 9,000 rubles. (59,000 rubles * 18/118).

- For the amount of VAT calculated by the buyer-tax agent, from the amount of the advance payment issued (for the seller);

- For the amount of VAT on prepayment, accepted for deduction, in accordance with Art. 171 of the Tax Code of the Russian Federation, by the buyer-tax agent (for himself).

Note, that for this operation the VAT of the tax agent is recorded on account 68.52 “VAT of the tax agent for certain types of goods” (clause 8 of article 161 of the Tax Code of the Russian Federation).

At the same time, records are made in the registers "Invoice Logbook", "VAT Sales" and "VAT Purchases" to store information about the received invoice, indicating the type of value and event.

To reflect the receipt document, crediting the advance to the supplier and accounting for incoming VAT, we use the document "Receipt (act, invoice)" with the type of operation "Goods (invoice)". The document can be issued in the section "Purchases" / subsection "Purchases" / "Receipt (acts, invoices)".

Let's create a new document and fill it in according to the data received from the supplier. When posting a document, the accounting register reflects the entries for offsetting the advance to the supplier, the cost of scrap metal received from the supplier and the amounts of VAT calculated by the tax agent for the seller, based on the amount of delivery.

In the register "VAT presented" will be added records for the type of movement "Arrival". In this case, the value "Goods (tax agent)" will be reflected in the "Type of value" field.

According to Art. 168 (p. 5) of the Tax Code of the Russian Federation, the supplier-payer of VAT when shipping non-ferrous metal scrap is obliged to issue an invoice to the buyer.

After recording the invoice received, postings are generated on account 76.NA - for the amount of VAT calculated by the buyer-tax agent for the supplier from the cost of delivery, and an entry will appear in the "VAT Sales" register indicating the type of value "Goods (tax agent)" and "VAT accrued payable" event.

Scrap metal is taken into account. Now the buyer-tax agent has the right to a tax deduction for VAT:

- According to paragraph 15 of Art. 171 of the Tax Code of the Russian Federation - VAT deduction after shipment of goods - for the seller;

- According to paragraph 3 of Art. 171 of the Tax Code of the Russian Federation - VAT deduction from the cost of purchased scrap - for oneself.

Regulatory VAT operations

- Formation of sales book entries

- Formation of purchase book entries

If all transactions during the period are performed without errors and "manual" adjustments, the regulatory VAT documents "Formation of sales book entries" and "Formation of purchase book entries" are generated automatically using the "Fill" button. For convenience, users can use the "VAT Assistant" in the section "Operations" / subsection "Closing period".

After the regular operations of VAT reflection in the purchase book and in the sales book, entries will appear on transactions:

- With an operation code of type 41 - calculation of VAT on payment (prepayment) - for the supplier;

- With transaction code of type 43 - VAT recovery from payment (prepayment) by the buyer - for himself;

- With an operation code of type 42 - calculation of VAT on shipment - for the supplier.

Since the amount of tax payable to the budget for non-ferrous metal scrap buyers who are tax agents is calculated as the total amount increased by the restored VAT and reduced by the amount of tax deductions (details can be found in Article 170-0172 of the Tax Code of the Russian Federation), in our example the amount payable will be 0 rubles:

The amount of VAT calculated by the buyer - tax agent - 27,000 rubles.

- 9 000 rub. – VAT calculated from advance payment (per supplier);

- 9 000 rub. – VAT calculated from the shipment (for the supplier);

- 9 000 rub. – VAT recovered from the prepayment amount after the delivery of scrap (for oneself).

The amount of VAT for which the buyer-tax agent has the right to deduct is 27,000 rubles.

- 9 000 rub. – VAT deductible after prepayment (for oneself);

- 9 000 rub. – VAT deductible after shipment of scrap (for the supplier);

- 9 000 rub. – VAT deductible after the delivery of scrap (for oneself).

The procedure for filling out a VAT tax return obliges tax agents to fill out section 2 of the declaration. But section 2 does not ensure compliance with the control ratios of indicators (this requirement is contained in the letter of the Federal Tax Service of the Russian Federation No. GD-4-3 / [email protected] from 03/23/2015).

For taxable items - sales book entries

- On line 030 - data with an operation code of the form 42;

- On line 070 - amounts with an operation code of the form 41;

- On line 080 - amounts with an operation code of the form 44;

- On line 090 - amounts with an operation code of the form 43.

- On line 120 - amounts with transaction codes of the form 42, 44;

- On line 130 - amounts with an operation code of the form 41;

- On line 170 - amounts with an operation code of the form 43.

We considered the reflection of accounting operations for the activities of a tax agent in the 1C system.