How to close the month in 1s 8.3. Accounting info. Restoring the state of settlements

To generate scheduled VAT transactions, open the section Operations - Closing the period - Scheduled VAT transactions:

Create:

- – an operation to restore VAT amounts accepted for deduction at a zero rate. When creating an operation in the header, you need to specify where the tax amount will be entered - in the book of purchases or sales.

- Real estate VAT recovery– an operation to restore tax amounts on real estate objects that are put into operation and used for VAT-free transactions, in accordance with paragraph 2 of Article 170 of the Tax Code of the Russian Federation.

- Calculation of VAT on construction and installation works using a household method- this operation charges VAT on construction and installation works performed by the organization itself and not taken into account for construction objects as fixed assets (according to clause 10 of Article 167 of the Tax Code of the Russian Federation).

- Zero VAT rate confirmation– this transaction confirms or does not confirm the zero VAT rate for sales transactions.

- Confirmation of VAT payment to the budget- the operation registers the fact of receiving a tax mark in .

- VAT distribution– allocates VAT to taxable, non-taxable, or zero-taxable transactions for valuables written off as expenses.

- Write-off of VAT- the operation is intended to be written off as expenses for VAT, which is presented by the supplier, but cannot be accepted for deduction.

- – the transaction reflects VAT deductions for invoices that were not included in the purchase book earlier, as well as for invoices where tax is deductible in installments.

- - an operation to restore VAT from advances and reflect the amounts in the sales book.

How to find and fix VAT errors in 1C 8.3 for proper accounting and VAT reporting, read in.

VAT Accounting Assistant

To work with the VAT routine operations in 1C 8.3, there is an assistant. It checks the correctness and sequence of these operations for the correct filling of purchase and sales books, as well as VAT returns. The assistant is located in the section Operations - Period Closing - VAT Accounting Assistant:

In addition to the list of operations to be performed, the assistant fixes the status of each of them:

- Awaiting execution;

- Completed, up-to-date;

- Done, not relevant.

For the correct formation of the VAT declaration, all transactions must have the status Done, up-to-date:

Attention! If in 1C 8.3 VAT transactions were created in the process of work as needed, then it is recommended to use an assistant before compiling reports and repost the specified list in chronological order. How to do it .

Closing the month in 1C 8.3 Accounting step by step

This procedure consists of routine operations. Each operation is carried out by a separate document in a certain sequence. To generate scheduled operations, open the section Operations - Period Closing - Scheduled Operations:

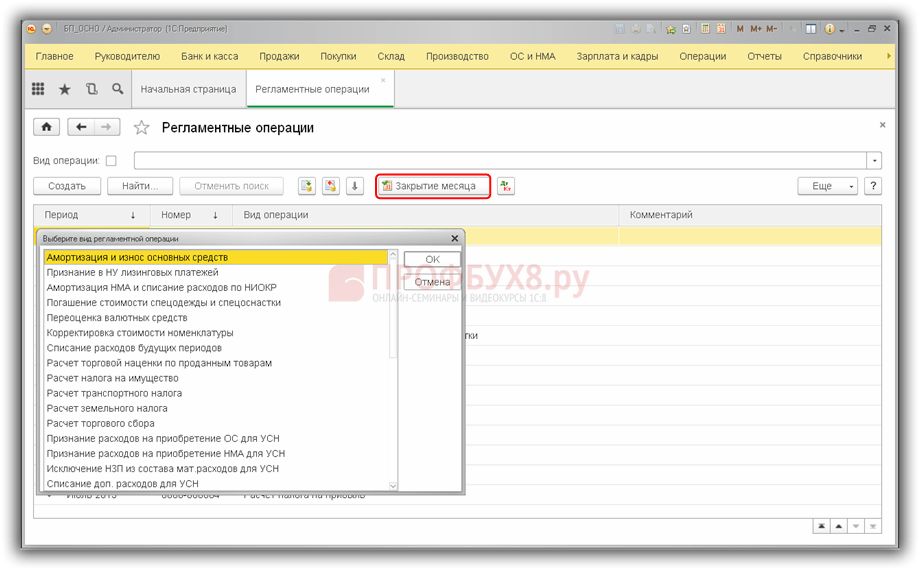

The list of all possible operations in the 1C 8.3 program is available by clicking the button Create. However, it is not recommended to create operations manually, 1C 8.3 itself determines the necessary list according to the established program settings, the organization's accounting policy and the primary documents posted:

Step 1. Setting up the month-end closing procedure

Accounting Settings

After checking the box in 1C 8.3, functionality will appear for accounting for special clothing, devices, and equipment.

For equipment, for which the useful life is established by the primary documents, at the end of the month, a settlement regulatory document will be created Repayment of the cost of overalls and special equipment.

To set up an accounting policy in 1C 8.3, open the section Main - Settings - Accounting policy:

When generating regulatory documents, the procedure for closing accounts 20, 23, 25, 26 is important. The rules for the distribution and write-off of costs are set by the user in the accounting policy settings on the tab Expenses. For example: if the organization's main activity is the performance of work or the provision of services, then it is necessary to establish the procedure for writing off costs from account 20:

By button indirect costs methods of distribution of overhead and general business expenses are established.

Step 2. Starting the month-end closing procedure

To automatically close the month and carry out the necessary routine operations in 1C 8.3, an assistant has been created Closing of the month:

1. Open the assistant section Operations - Period Closing - Month Closing or click the button Closing the month directly in the log of routine operations:

2. Install period closures:

3. If the 1C 8.3 database keeps records not for one, but for several organizations, then indicate name of company for which the closure is performed.

4. To restore the chronological sequence of entered documents, use the function Conducting documents per month. If reposting is not required, open the hyperlink and click Skip operation.

5. To start the calculation of regulatory documents, click the button Perform month-end closing.

Step 3. The sequence of closing the month in 1C 8.3

This procedure consists of 4 steps:

- The 1st stage includes settlement operations in various areas of accounting. They can be performed independently of each other as soon as they are ready, or not performed at all if accounting data is missing or settings are not enabled. For example: if there are no deferred expenses in accounting, then they will not be calculated.

- It is possible to proceed to the 2nd stage only after the calculation of all operations of the 1st stage, as they may affect the amount of expenses. The stage consists of one operation Calculation of write-offs of indirect expenses, which determines the ratio of write-offs of indirect expenses between types of activities with different taxation systems.

- At the 3rd stage:

- closing production and commercial expense accounts;

- calculation of the actual cost of semi-finished products and finished products, works and services produced per month;

- adjustment of the cost of sold products (works, services);

- distribution of expenses by type of activity for organizations on the simplified tax system and for accounting for individual entrepreneurs.

- At the 4th stage, the amount of income tax is calculated for the month. When performing scheduled operations for December, 1C 8.3 also performs the Balance Reformation operation.

The closing procedure is considered completed after all the listed operations have been completed, that is, each regulatory document must have the status Done, up-to-date. If the operation is performed with an error, then 1C 8.3 will assign it the appropriate status and suspend the closing of the month until the error is eliminated. You can find information about the error by clicking on the name of the operation.

To cancel the period closing procedure as a whole, use the button Cancel month end. To cancel a separate scheduled operation, press the button Cancel operation, while all subsequent operations will acquire the status Completed, outdated:

To get a brief report on the operations performed in 1C 8.3, use the button Report on the execution of operations.

Step 4. Reports on the closing operations of the month

You can get information about the purpose of each operation by clicking the button. Open Help in the journal Scheduled Operations:

Step 5. Postings and registers

After completing the procedure for each operation in 1C 8.3, accounting entries and registers are available. To open the records for viewing, click on the name of the operation and press the button

The data editing prohibition date is a functionality of the 1C 8.3 BP program that allows you to restrict the entry and modification of documents for a certain period of time. Speaking in the language of accountants, it is necessary to “close the period in 1C”. The ban can even be set for specific users and organizations in the database so that no one can make changes.

The instruction is relevant both for 1C Accounting and for other programs created on the basis of the Library of Standard Subsystems (Trade Management 11, ERP 2.0, 1C ZUP 3.0, 1C UNF, and so on).

Where to find the date of prohibition of editing in 1C 8.3? This function is located on the "Administration" tab, in the "Support and maintenance" section:

If you have not yet included the editing prohibition date in 1C 8.3, then set the required flag:

How to open and close a period

First you need to decide whether we will differentiate the rights to change by users or we will use the date for everyone:

For example, let's choose the option "By users". Now it became possible to specify individual settings for each employee.

Example: for employees "Sergeev" and "Ivanov" you need to set the date of editing 01/01/2016, and for the rest - 01/03/2016.

To organize this option, you must:

Get 267 1C video lessons for free:

Now let's complicate the task. For the user "Ivanov", you need to put a restriction on changing the data of the organization "Konfetprom", like for other users, on 03/01/2016.

We select an employee in the list and set the switch "Method of specifying the date of the ban" in the position "By objects" in the lower part of the screen:

The menu for setting the editing date by organization will appear. Using the "Select" add the desired organization to the table and write the date of the ban:

Setting a "dynamic" ban date

The method described above is not always convenient: it requires constant administration. That is, every month / quarter / year, the date will need to be set manually.

In 1C there is a way to simplify - setting a "dynamic" ban date. That is, the program can be configured so that the system will automatically “move” the date of the ban. An example is at the end of the year, month, quarter, week, day.

It's easy to set up. As you probably noticed, in all the settings above there is a field "Date of the ban". Just it is responsible for this setting.

Common date for all users:

Or customization:

Date of prohibition of data loading in 1C BP 3.0

We will also touch on the topic of prohibiting data loading into the 1C 8.3 program. It happens that very unpleasant situations happen when any data in a closed period is received from the management base (for example, UT) to the accounting 1C.

Closing at the end of the month in accordance with the order of the Ministry of Finance of the Russian Federation dated 10/31/2000. No. 94n "On the approval of the Chart of Accounts" are subject to accounts 25 and 26, which should not have a balance at the end of the month.

Also, in accordance with the Instruction on the application of the chart of accounts, accounts 20, 23, 29, as well as accounts 90 Sales and 91 Other income and expenses are subject to closing at the end of the month.

In addition, at the end of the year, the accountant needs to prepare regulated reports. To do this, the balance sheet is reformed in December.

How to close the month in 1C 8.3

It is necessary to close the period in 1C 8.3 regularly and consistently. With the help of an assistant Closing of the month such as writing off deferred expenses, depreciation and other necessary operations for the correct distribution of income and expenses and the calculation of income tax. To launch the Monthly Closing Assistant in 1C 8.3, you need to open the Operations section:

Getting into the assistant for closing the month, first of all, you need to set the period - the month that will be closed:

If you switched to 1C 8.3 from another program or entered balances manually, for example, entered balances on December 31, 2013, and accounting began in January 2014, then we select for closing the month in which the first accounting entries began.

Month closing can be done in two ways:

- Full automatic closing;

- Partial closure. In this case, it is necessary to perform one scheduled operation, or it is necessary to do all but one.

The sequence of closing the month in 1C 8.3

To perform this operation in 1C 8.3, after selecting the closing period, click on the Close month button, after which the 1C 8.3 program will perform the following actions:

- Re-posting of documents, that is, putting them in chronological order by time and dates;

- The presence of the document Payroll for the selected month is checked to reflect the amounts of wages and contributions on the expense accounts.

If the 1C 8.3 program does not have a Payroll document for the selected month, then the program creates a document at the end of the period. The amounts of accrued salaries are put down in accordance with the salaries of employees.

Also, when closing the month in 1C 8.3, the following is carried out:

Depending on the organizational and legal ownership, as well as the chosen taxation system, the set of routine operations in 1C 8.3 may differ, for example:

Or, for example:

At the end of the month closing, all scheduled operations on the screen will be highlighted in green:

And the status of the Month-end closing operation will be Executed:

If the closing of the month is not carried out in 1s 8.3

Such a result of closing the month is possible only if there are no accounting errors. If there are errors, then the 1C 8.3 program will not perform the operation and will highlight the operation in red in the assistant:

It will also give an informational message about where the error is and how to fix it:

After correcting the error, you must close the informational error message and click the Close Month button again. The 1C 8.3 program will continue to close the month from the operation in which there was an error:

In addition, at the close of the last month of the quarter (in our case, March), the 1C 8.3 program checks for the availability of VAT accounting documents, that is, the formation of a purchase book and a sales book:

Upon completion of each scheduled operation, we can look at the accounting entries or the document by which this operation was made (if possible), and also look at the reference-calculation for the operation. To do this, click on the required operation with the left mouse button and select the required detail:

In 1C 8.3, all reference calculations that can be generated at the end of the month can be seen using a special button in the upper right corner of the month closing assistant:

balance reformation

At the end of the year, when the month of December is closed in 1C 8.3, an additional operation Reformation of the balance sheet appears:

This operation closes accounts 90 and 91 to account 90.09 “Sales profit/loss” and 91.09 “Balance of other income/expenses”. Account 99 is written off to 90.09 and 91.09 and so on.

After the closing of the month, the result of the balance sheet reformation can be seen in the form of accounting entries:

If, for example, you need to perform the OS Depreciation operation right now from scheduled operations, then in the assistant for this you need to left-click on the desired operation and select the Perform operation item:

At the end of the operation, 1C 8.3 will issue an informational message:

If you try to make an operation from the second or third block of the assistant, for example, calculating the reserve for doubtful debts, then the 1C 8.3 program will issue an informational message about the impossibility of performing the operation:

This is because in the Month Closing Assistant, the operations are arranged in such a way that the sequence of closing accounts is observed in accordance with PBU. The 1C 8.3 program will offer to perform all the necessary operations preceding the selected one.

If you do not want to perform all operations, but only the selected one, you can skip all previous scheduled operations:

Attention! To skip an operation means to refuse to perform this operation in the current month. The actual closure of accounts for this operation will not occur, which threatens with unreliable data in accounting.

In order to correctly generate reporting 1C Accounting 8.3, at the end of each month you need to “Close the month”. You can do this in 8.3, as in other versions, so you can use the current universal instruction.

Closing the month in 1C 8.3 accounting step by step

Closing the month in 1C should be done step by step in sequence, with the completion of each stage:

- We launch the "Assistant" by opening the "Operations" section.

- In the "assistant" we set a certain period that needs to be closed. If the transition was made to 1C 8.3 not from the assistant, or the balances were entered manually, then you need to select the month for closing in which the primary accounting entries were started.

You can close the month like this:

- Automatically and completely.

- Partially - perform one routine manipulation or as many as required.

- After the selected period in 1C 8.3, click on "Close the month."

- Wait a while. The program will automatically rescan the documents and check them. Also payroll for the specified month to reflect the amounts and investments about expenses. If there is no document in the payroll program, then when the period is closed, the program will create a document. Based on the organizational and legislative ownership and the individuality of the taxation system in 1C 8.3, they may differ.

- After the end of the closing of the month, each completed routine operation of the program will be highlighted in green and the month will close.

Often in accounting programs it is necessary to prohibit making changes to old documents. For example, after the reporting has already been submitted. The human factor plays a huge role when working with any accounting program. So that an employee, unknowingly or by chance, does not make changes to such documents, 1C 8.3 Accounting 3.0 provides for a mechanism for closing dates for periods.

Where in 1C 8.3 to find the date of the ban? In the "Administration" menu, select the "Support and maintenance" item (if you have the appropriate rights).

In the "Regulatory operations" subsection, set the flag on the item "Change prohibition dates". To the right, you will have the opportunity to go to its settings.

After clicking on the hyperlink to the settings that appears, the corresponding form will open. First you need to specify whether the ban date is set for all users, or only for certain ones. These two methods differ only in that in the second case it will be necessary to specify a list of users or user groups to which this ban will be applied.

Setting the ban date "By users"

If the "By users" setting type is selected, the ban dates are configured for each user or group of users. To do this, select the appropriate line and specify the value in the "Ban date" field.

Setting the ban date "By objects"

In the 1C Accounting 3.0 program, it is possible to distinguish between the date of the ban by organization. This method is relevant when the program records several organizations at once.

At the bottom of the form, in the "Other ways to specify the ban date" section, select the "By objects" drop-down list item. In the tabular section that appears, those organizations are indicated for which data editing should be banned. Each organization has its own date.

If this setting is not made for all users, then each has its own list of organizations and dates. It is permissible for one user to set the "By objects" method, and for the other the general date.

Total ban date

In the case when the ban date is common for both users and organizations, the setting will look like the figure below.

Dynamic ban date

Rigidly setting a ban date is often inconvenient, as it requires constant monitoring of relevance and change. There is no guarantee that next time it will be installed on time.

In order to avoid mistakes and unpleasant situations in the future, it is recommended to set “End of last year / quarter / month / week”, or “Last day”. This setting method will automatically rearrange the ban date.

Setting the Data Upload Prohibition Date

In the event that you have set up synchronization with other 1C databases and unwanted data may get into past periods, use the setting of the data upload prohibition date.

From the Administration menu, select Data Sync.

When data synchronization is enabled, you will be able to check the "Date of prohibition of downloading". Install it and follow the hyperlink that appears to go to the settings.

Setting the download prohibition date is similar to setting the data editing prohibition date. Their difference lies in the fact that here, instead of distinguishing by users, division by infobases with which synchronization is performed is available.